Banks and lenders use Bud's affordability solution to bridge information sharing between customer and collections teams to drive better outcomes and support vulnerable customers.

30% decrease in consultation time

Consultation times reduced and customer success improves

£4m/day in written-off debt

Reduce the £4m that is written-off daily by lenders in the UK

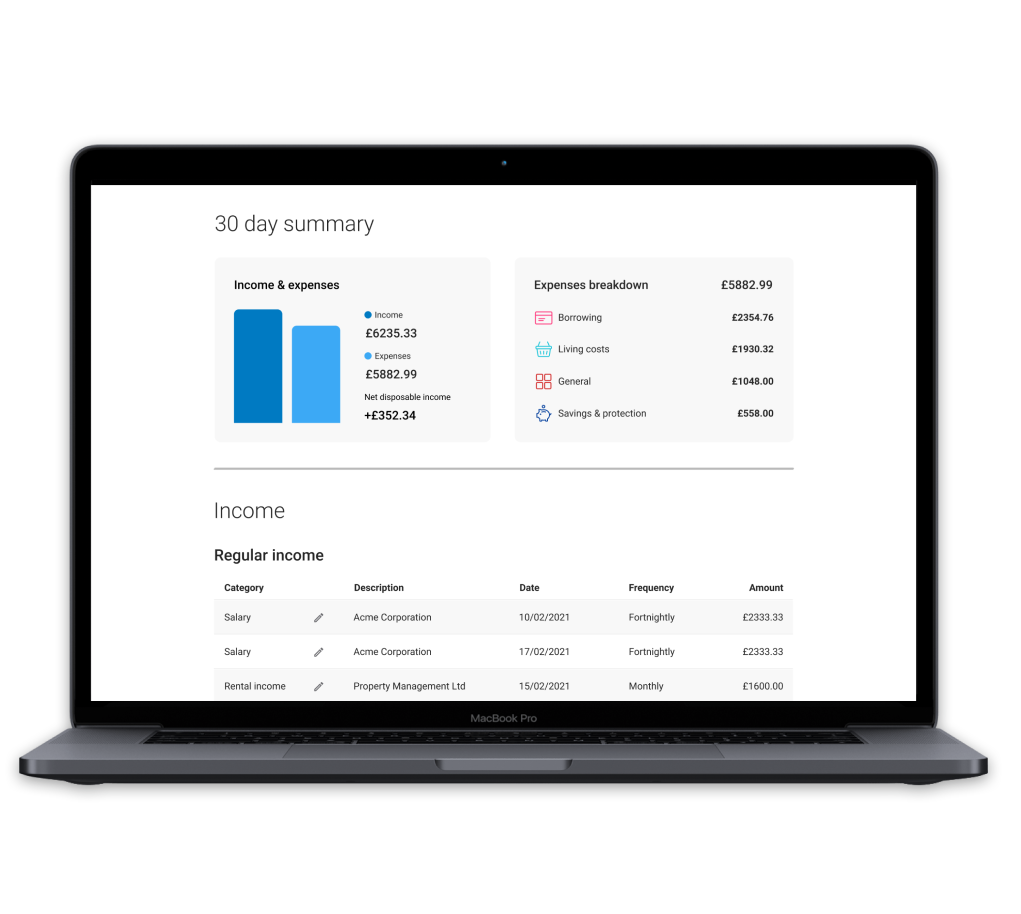

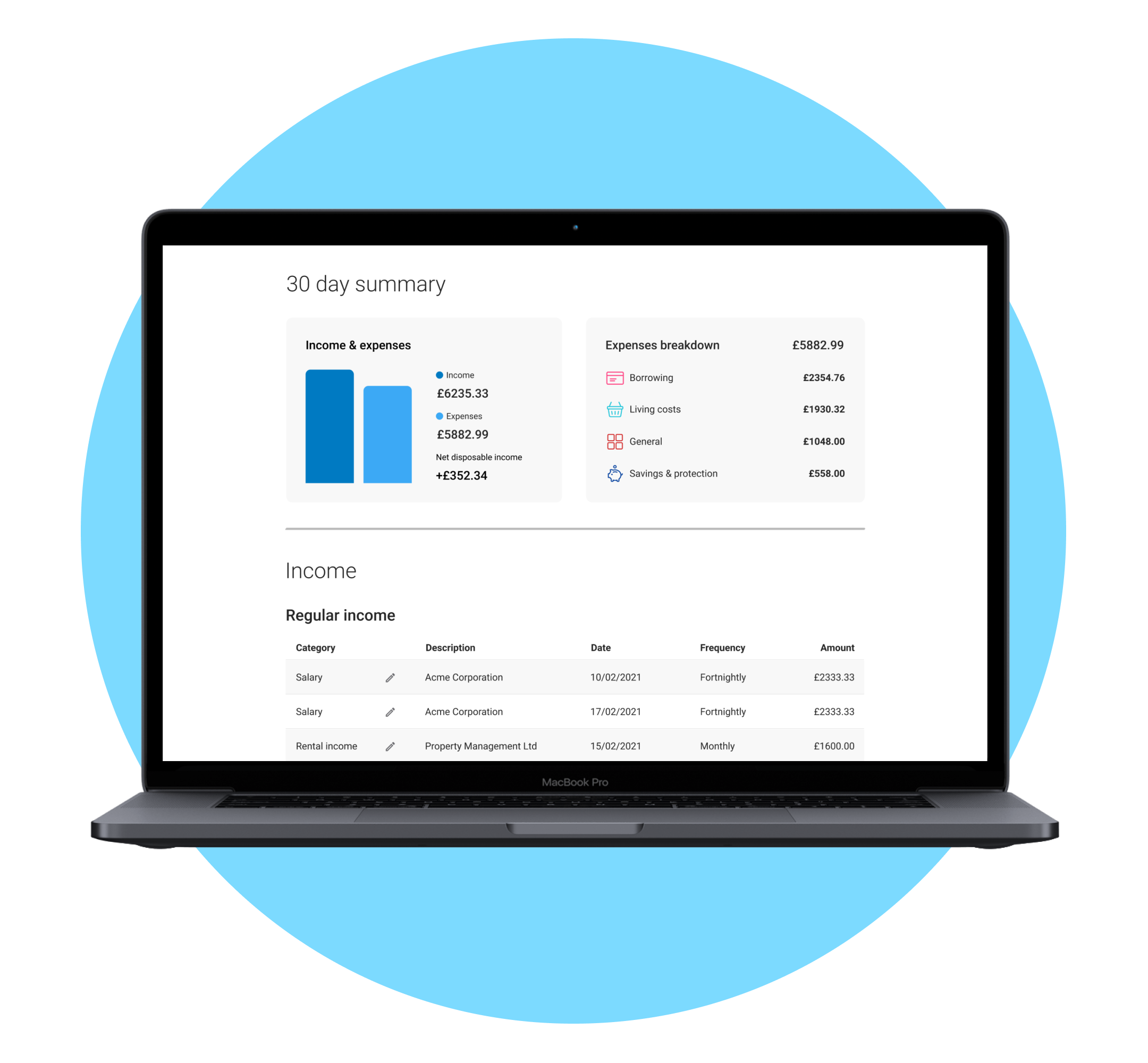

How it works

Here's how Bud can help both customer and collections to share information with ease and clarity.

Connect

Customer connects via Open Banking to share transaction dataEnrich

Data ingested is enriched to add new metadata such as category, merchant ID, income regularity and moreAnalyse

Enriched data is analysed to give advisors a clear picture of factors affecting repaymentsReport

Flexible dashboard and static reports help collections teams to support customers with manageable repayment programmesKey features at a glance

Ingest first party data, Open Banking and physical statements

Best-in-class categorisation models, critical for debt advice

Key insights like income stability

Compare against CRA data in one place

Configured dashboards

Faster collections process with better outcomes

Our Customers

What our customers are saying about Bud

Importantly, the functionality Bud provides will also enable us to continue to meet our responsibilities as a responsible lender, without compromising customer experience.

Mike Bullock

Chief Information Officer, ANZ NZ

Partnering with Bud will empower our customers, by ensuring that their data works even better in their favour, helping them move their finances forward.

Alastair Douglas

CEO, TotallyMoney

- DEVELOPERS

- Platform

- API docs and guides

- Market coverage

- RESOURCES

- Reports

- News from Bud

- REGION

- United Kingdom

- United States

Bud is the trading name of Bud Financial Limited, a company registered in England and Wales (No. 9651629).

Bud Website – Privacy Policy | Website terms and conditions | Cookie Notice | Privacy Settings | For consumers: Your rights – Payments

Bud® is authorised and regulated by the Financial Conduct Authority under registration number 765768 + 793327.