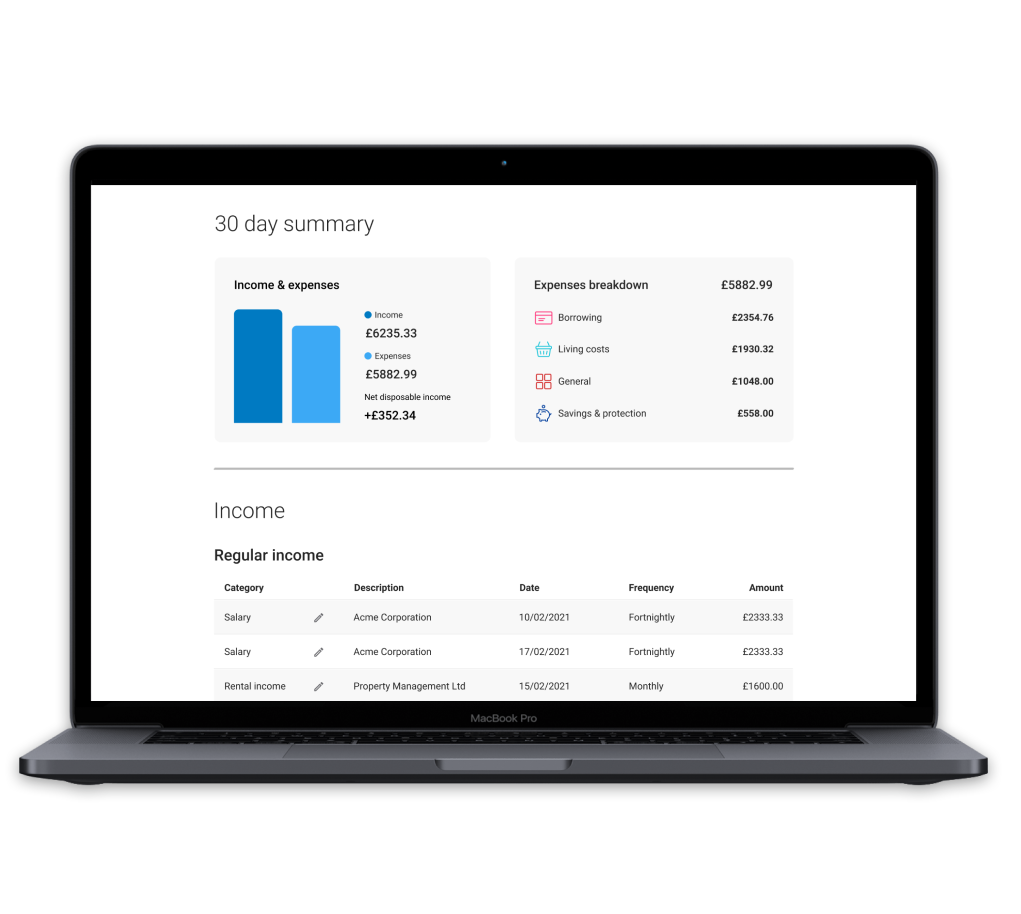

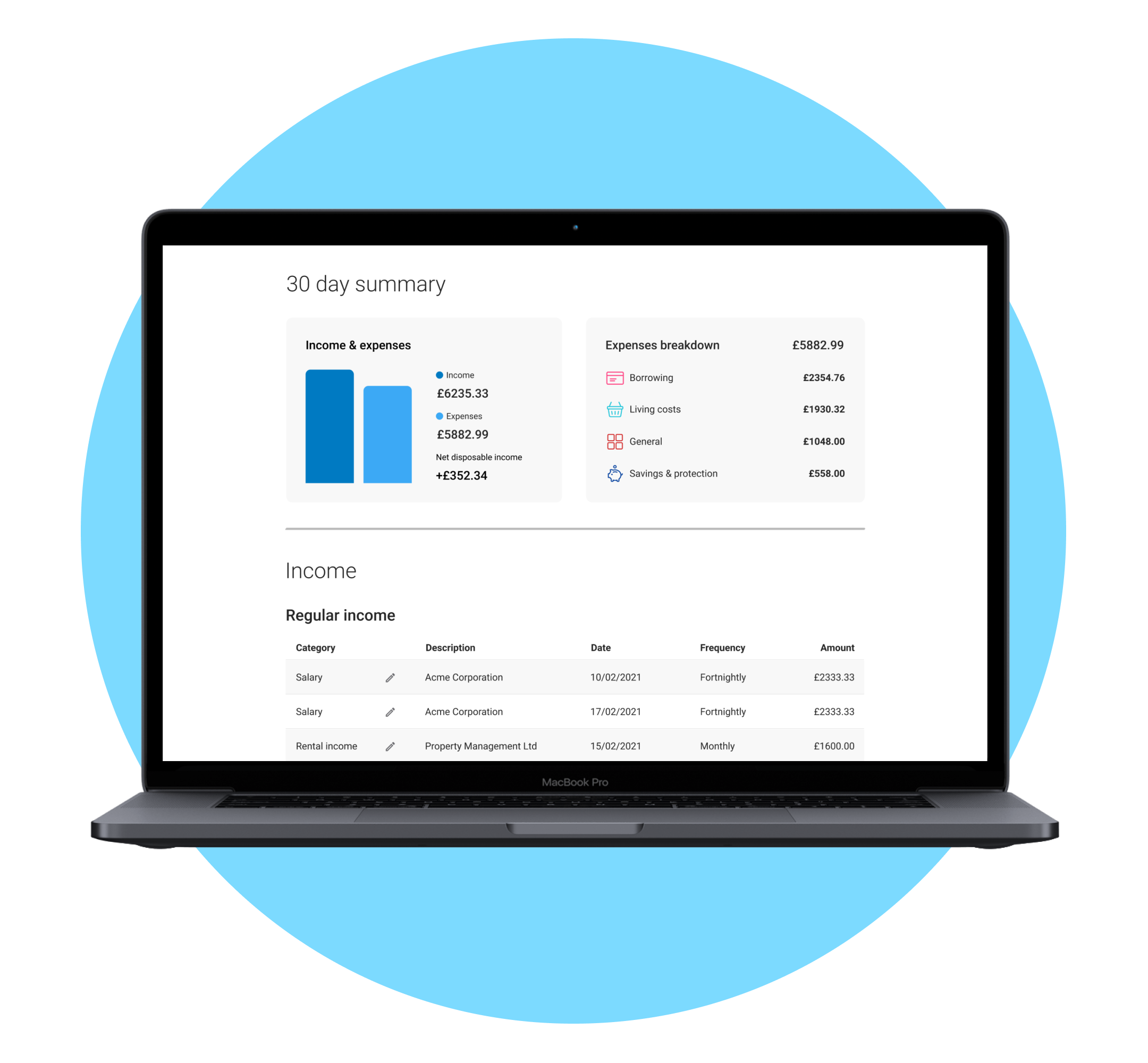

Banks and lenders use Bud's affordability solution to create operational efficiencies to manage regulatory exposure and reduce credit risk.

87% faster onboarding by pre-filling loan application forms

22% decrease in loan defaults

How it works

Here's how Bud can help you make fast and informed lending decisions.

Connect

Customer connects accountEnrich

Ingested data is enriched to add meta data like category, merchant ID and more...Analyse

Enriched data is analysed and used to pre-populate application form for the customer and provide in-depth profiling insights to the lenderReport

Credit modelling improved and analyst makes faster, informed lending decisionsKey features at a glance

Ingest first party data, Open Banking and physical statements

Best-in-class categorisation models, critical for risk analysis

Key insights like income stability and gambling expenditure

Static reports for audit and compliance

Dashboard available with customisations

Mobile (SMS) approval initiation

Our Customers

What our customers are saying about Bud

Importantly, the functionality Bud provides will also enable us to continue to meet our responsibilities as a responsible lender, without compromising customer experience.

Mike Bullock

Chief Information Officer, ANZ NZ

Partnering with Bud will empower our customers, by ensuring that their data works even better in their favour, helping them move their finances forward.

Alastair Douglas

CEO, TotallyMoney

- DEVELOPERS

- Platform

- API docs and guides

- Market coverage

- RESOURCES

- Reports

- News from Bud

- REGION

- United Kingdom

- United States

Bud is the trading name of Bud Financial Limited, a company registered in England and Wales (No. 9651629).

Bud Website – Privacy Policy | Website terms and conditions | Cookie Notice | Privacy Settings | For consumers: Your rights – Payments

Bud® is authorised and regulated by the Financial Conduct Authority under registration number 765768 + 793327.