Banks and lenders use Bud's solution to provide tools for customers to familiarise themselves with transactions and support staff with information to resolve disputes at speed.

24% decrease in transaction dispute costs

Reduce dispute traffic, costs and claims

£13.60 decrease in cost-to-serve over customer lifetime

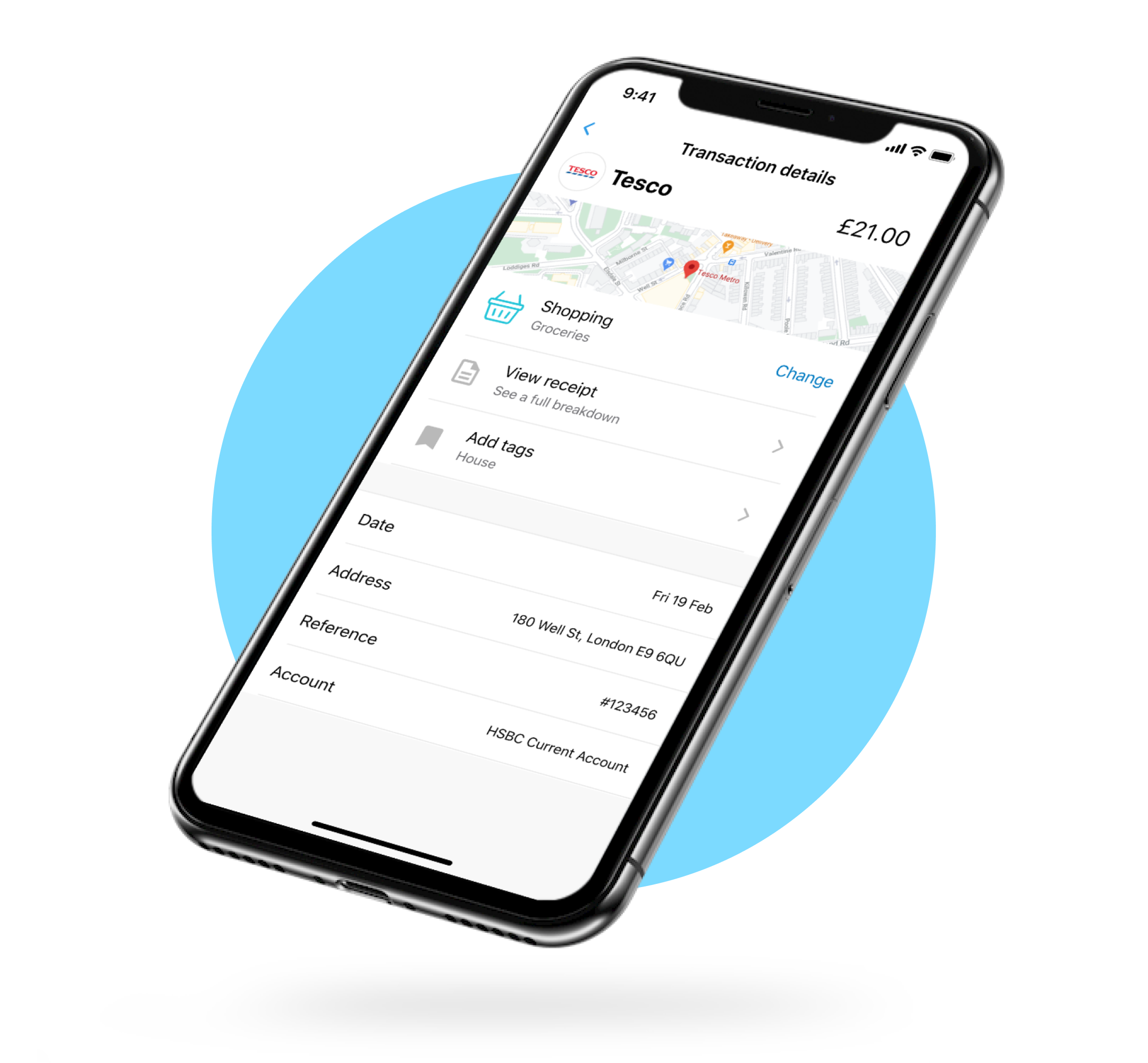

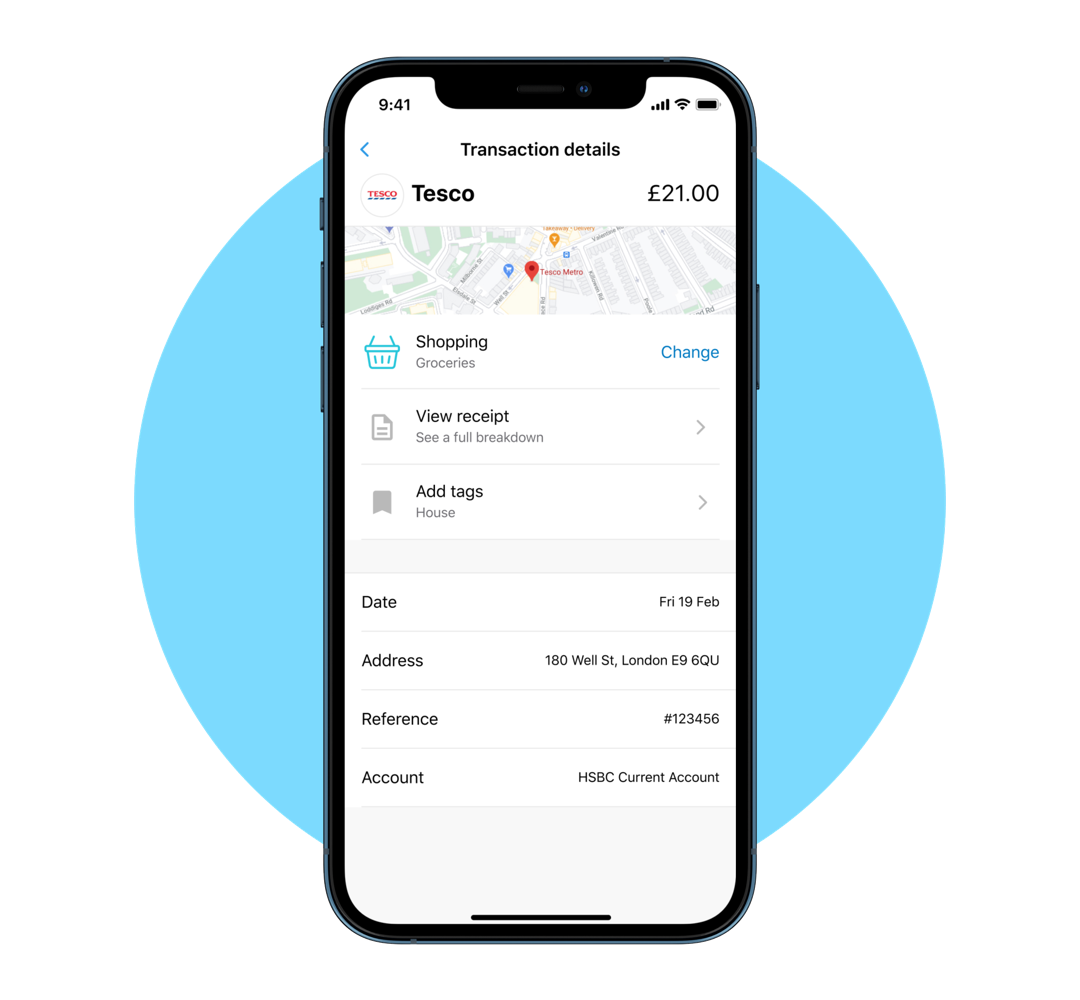

Categorise transactions, provide merchant logos and transaction location

How it works

Here's how Bud can help you reduce transaction disputes at source and build trust with customers.

Connect

Customer selects bank provider and connects accountAuthorise

Customer authorises with their bank credentialsTransactions

Customer has detailed record of merchant logo and geo-locations against transactionsResults

Both customer and customer service have more insight when handling queriesKey features at a glance

Ingest first party data with Open Banking

Over 3000 merchant logos

Merchant geo-locations

Real-time transaction enrichments

Proven enterprise scale, capable of batching thousands of transactions per second

Accurate data enrichments reducing dispute queries

Our Customers

What customers are saying about Bud

Importantly, the functionality Bud provides will also enable us to continue to meet our responsibilities as a responsible lender, without compromising customer experience.

Mike Bullock

Chief Information Officer, ANZ NZ

- DEVELOPERS

- Platform

- API docs and guides

- Market coverage

- RESOURCES

- Reports

- News from Bud

- REGION

- United Kingdom

- United States

Bud is the trading name of Bud Financial Limited, a company registered in England and Wales (No. 9651629).

Bud Website – Privacy Policy | Website terms and conditions | Cookie Notice | Privacy Settings | For consumers: Your rights – Payments

Bud® is authorised and regulated by the Financial Conduct Authority under registration number 765768 + 793327.