Say goodbye to forms, statements and payslips.

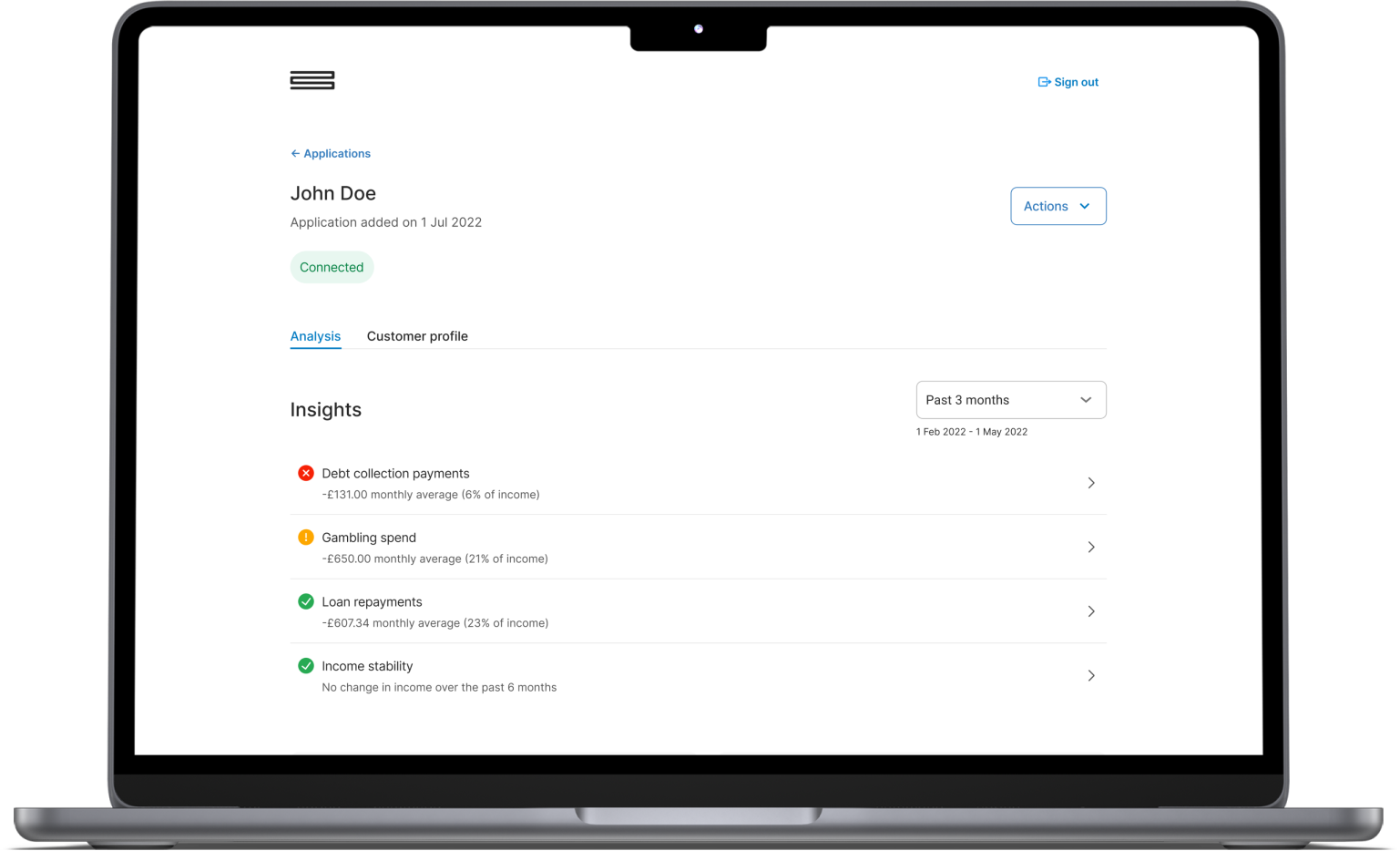

Empower your advisors with our simple dashboard for an automatic summary of income and outgoings as well as clever insights about each applicant.

Affordability made easy

An off-the-shelf affordability assessment dashboard for lenders that helps advisors make smarter and faster lending decisions.

Leading building with Bud

No more manual processing

Rich customer insights

Our intelligence services make sense of your customer’s real-time transactions data so you can see their financial position at a glance.

Frictionless onboarding

Improve your open banking adoption with our tried and tested Connect experience.

It’s simple, secure and prevents your applicants from dropping off or becoming frustrated by manual processes.

Understand your applicant

Income

Verify an applicant’s income and determine if it’s stable over time without having to manually review transactions or payslips.

Spending

Understand your applicant’s essential and discretionary spending. Get alerts about risky transactions such as gambling spend.

Existing products

Verify existing financial products and review commitments such as loan or debt collection repayments.

Transactions

See an applicant’s historical balance as a graph, plus their committed spend for the coming months.