Leaders building with Bud

Make better lending decisions

Faster onboarding

Improve onboarding times by 87% with Open Banking

Reduce defaults

Cuts default rates by 40-75% compared to industry standard

Reduce risk and decision time

Make credit decisions in minutes and eliminate inconsistencies associated with manual data entry. Up to 90% of a customers information can be automatically pre-filled with Open Banking.

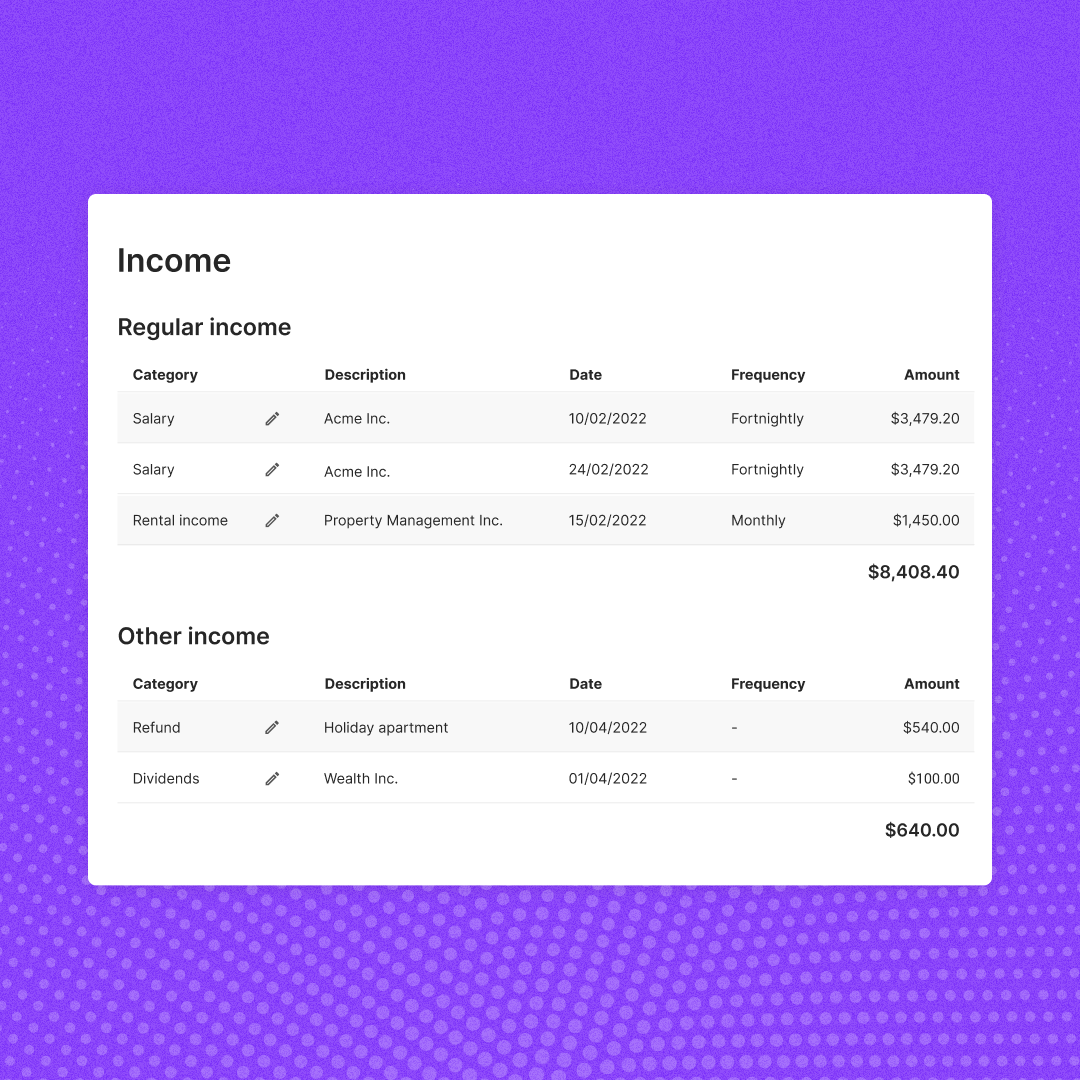

Verify income in an instant

A fast and accurate way to identify income sources, including non-traditional and gig economy income streams.

Have better conversations with your customers

Our technology can identify a wide-range of changes to a customers financial situation such as increases in income, missed payments and lazy cash.

How it works

Enrich

Ingested data is sent to Bud's Intelligence service, where it is enriched with metadata like category, merchant ID, income regularity and more.

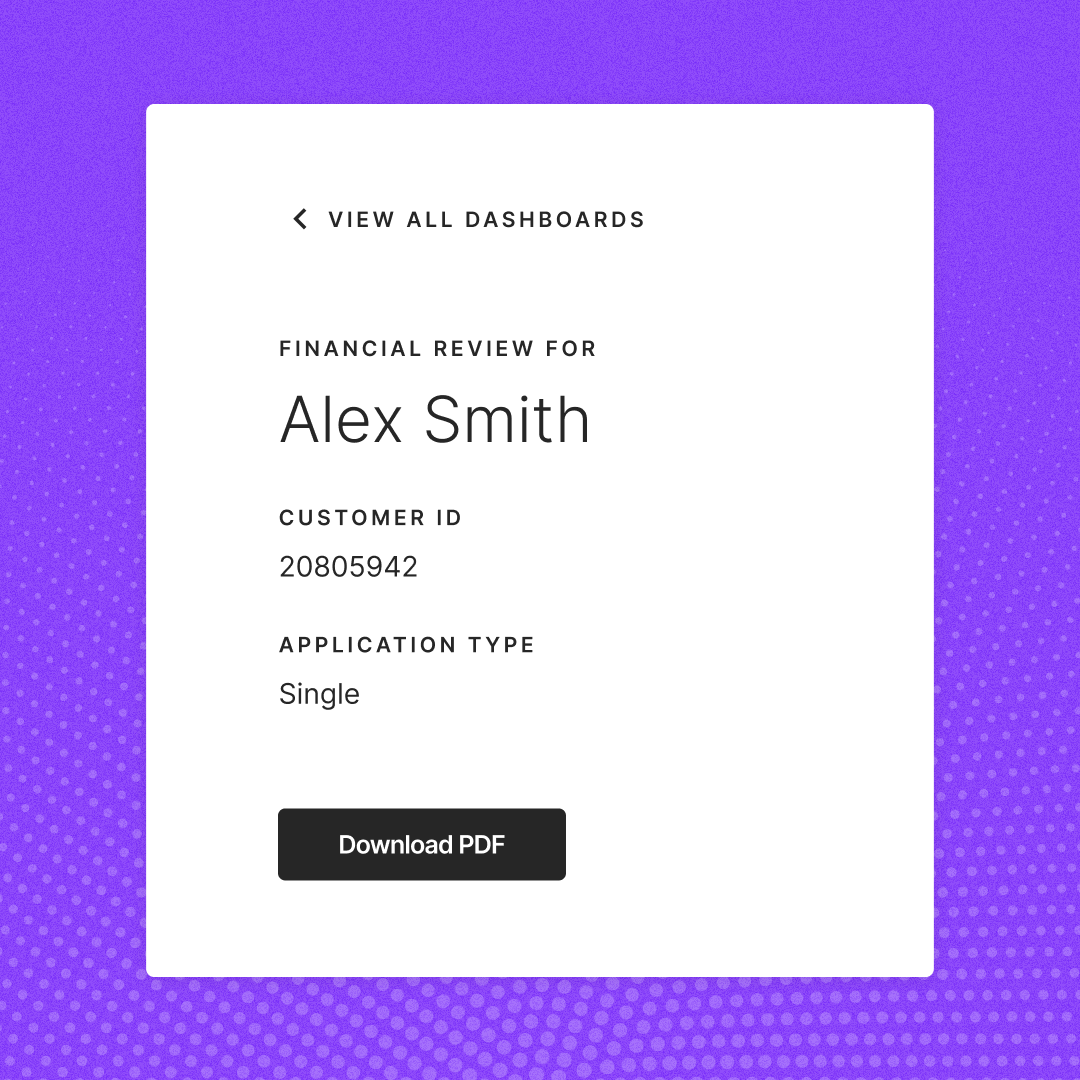

Analyse

Enriched data is analysed and used to provide in-depth profiling insights to the client.

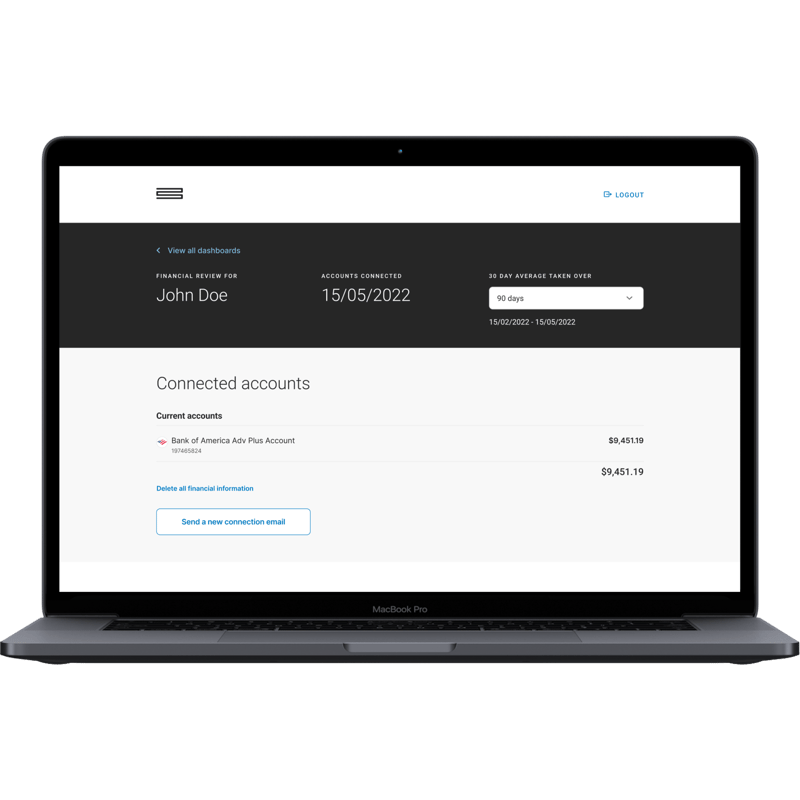

Report

Flexible dashboards and/or static reports are generated to help clients reach a fast and informed decision.

What our customers are saying about Bud