actions based on financial data

Timely, actionable insights

for each customer

Problem |

Raw customer data doesn’t provide the right level of insight to give customers useful, intelligent recommendations on which actions help them achieve their financial goals.

|

Solution |

Bud’s platform increases engagement and trust. It gives customers useful and tailored insights and allows providers to suggest helpful and timely offers that increase the likelihood of conversion. |

Products and features

Open Banking API

Receive and manage customer consent to securely access their current, credit card and savings account information and transaction data.

Core enrichments

Categorises transactions into more than 200 distinct categories, provides merchant names and logos and identifies recurring transactions

Signal data service

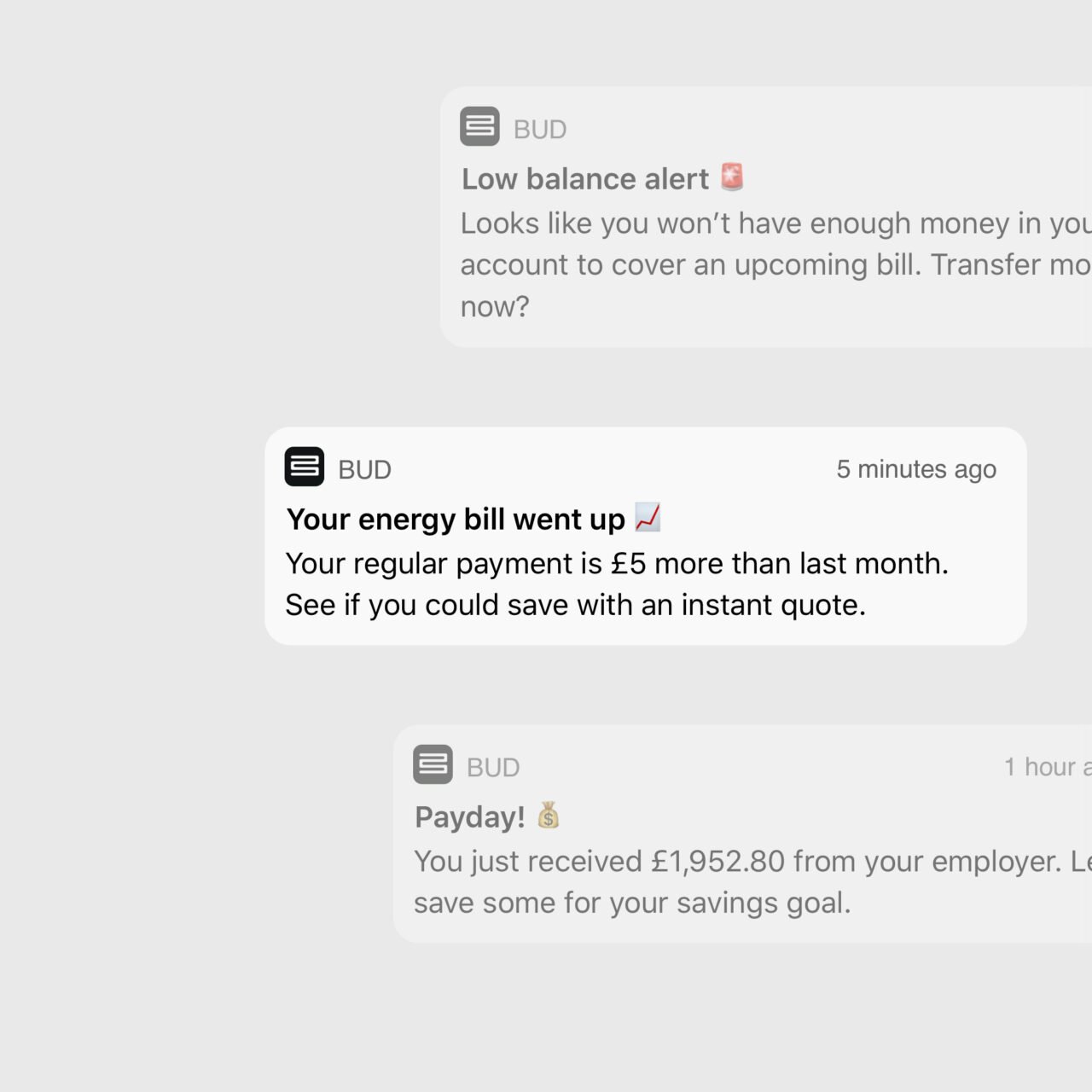

Signal provides clients with the smart triggers and notifications that prompt users to begin one of the journeys enabled by our Actions APIs

Actions APIs

Actions APIs are specific to the service they provide. Use cases featured here make use of the energy-switching and rent recognition APIs.

How it works

Use personalised insights to create timely actions for a customer that help them achieve their financial goals.

Find household expenses and recommend services designed to help customers save money on their bills.

Identify potential ‘red flag’ behaviours such as gambling and offer customers merchant blocking or category spend limits.

Reward your customers with loyalty programmes from specific merchants or build their credit history by verifying rent payments.

In use

Energy switching in the Bud app

Bud’s Signal and Actions services power the utility-switching journey within our app. Together, they recognise a customer’s energy payments and check for triggers that might prompt a switch (like an increase in their bills).

Customers can compare personalised quotes and complete a switch with our parter, GoCompare, all from inside the app.

In use

Rent Recognition

Bud’s Intelligence is the key component in the Rent Recognition solution developed alongside HM Treasury.

It identifies who the customer pays rent to and how much they pay before verifying those details and preparing a report that credit reference agencies, like Experian and Equifax, use to build credit files.

- DEVELOPERS

- Platform

- API docs and guides

- Market coverage

- RESOURCES

- Reports

- News from Bud

- REGION

- United Kingdom

- United States

Bud is the trading name of Bud Financial Limited, a company registered in England and Wales (No. 9651629).

Bud Website – Privacy Policy | Website terms and conditions | Cookie Notice | Privacy Settings | For consumers: Your rights – Payments

Bud® is authorised and regulated by the Financial Conduct Authority under registration number 765768 + 793327.