Problem |

Customer-created onboarding data makes taking informed decisions difficult for lenders and financial advisors. Misrepresentation or mistakes by an applicant can be costly, time-consuming and make confident judgements a challenge. |

Solution |

Bud helps advisors get a clear picture of their customer’s finances with more accurate data on their income, living expenses and any debt they may have. This provides lenders with the right financial data to make quick, informed decisions and gives customers a simple and straightforward experience with their application. |

Products and features

Open Banking API

Receive and manage customer consent to securely access their current, credit card and savings account information and transaction data.

Core enrichments

Categorises transactions into more than 200 distinct categories, provides merchant names and logos and identifies recurring transactions

Financial review data service

Provides custom categories so that clients can map Bud's enrichment services to their existing onboarding forms and provides a shortcut to category totals for a given period of time.

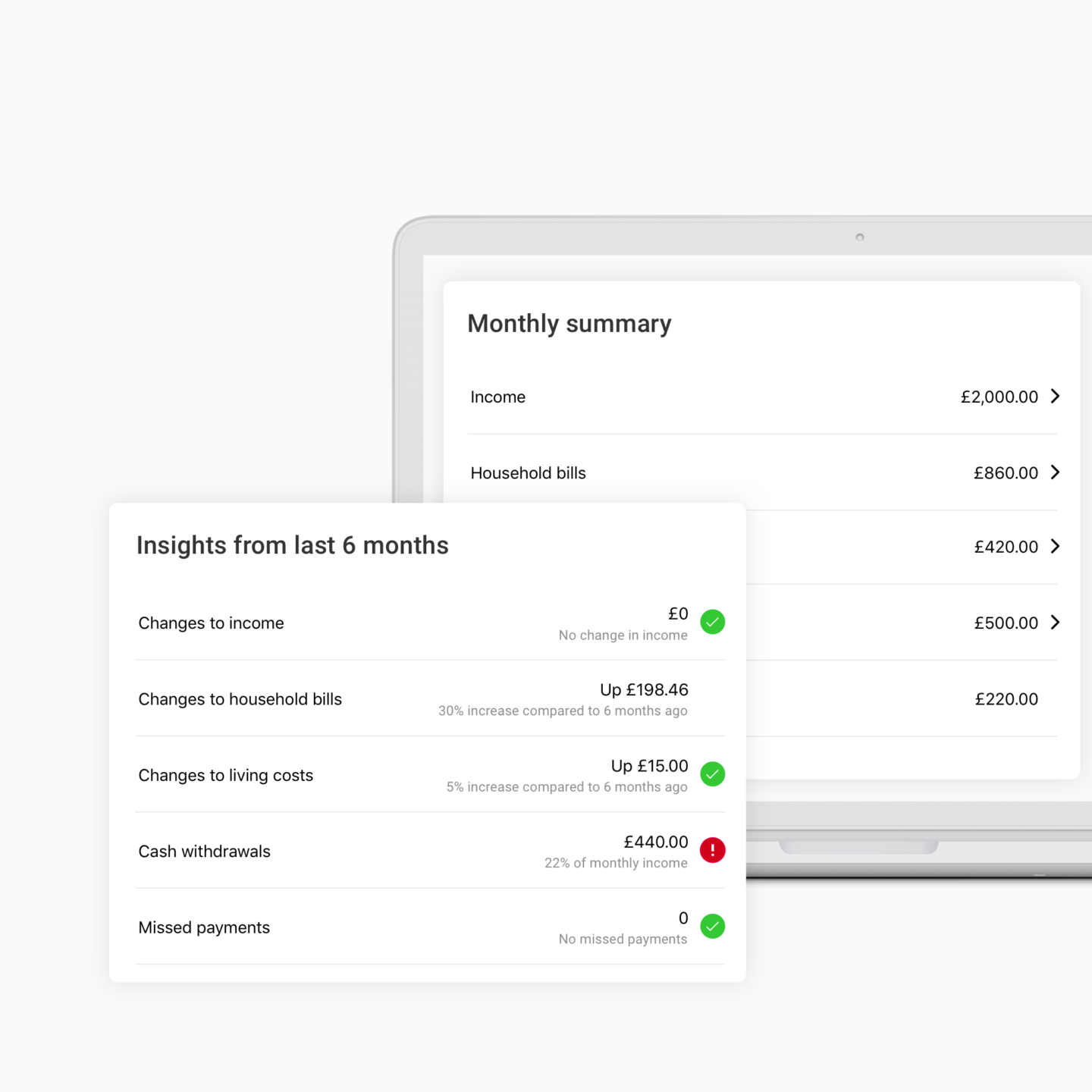

Insights API

Adds context by finding salary payments, other sources of income and calculating left-to-spend totals.

How it works

Customers connect all of their current, credit cards and savings accounts.

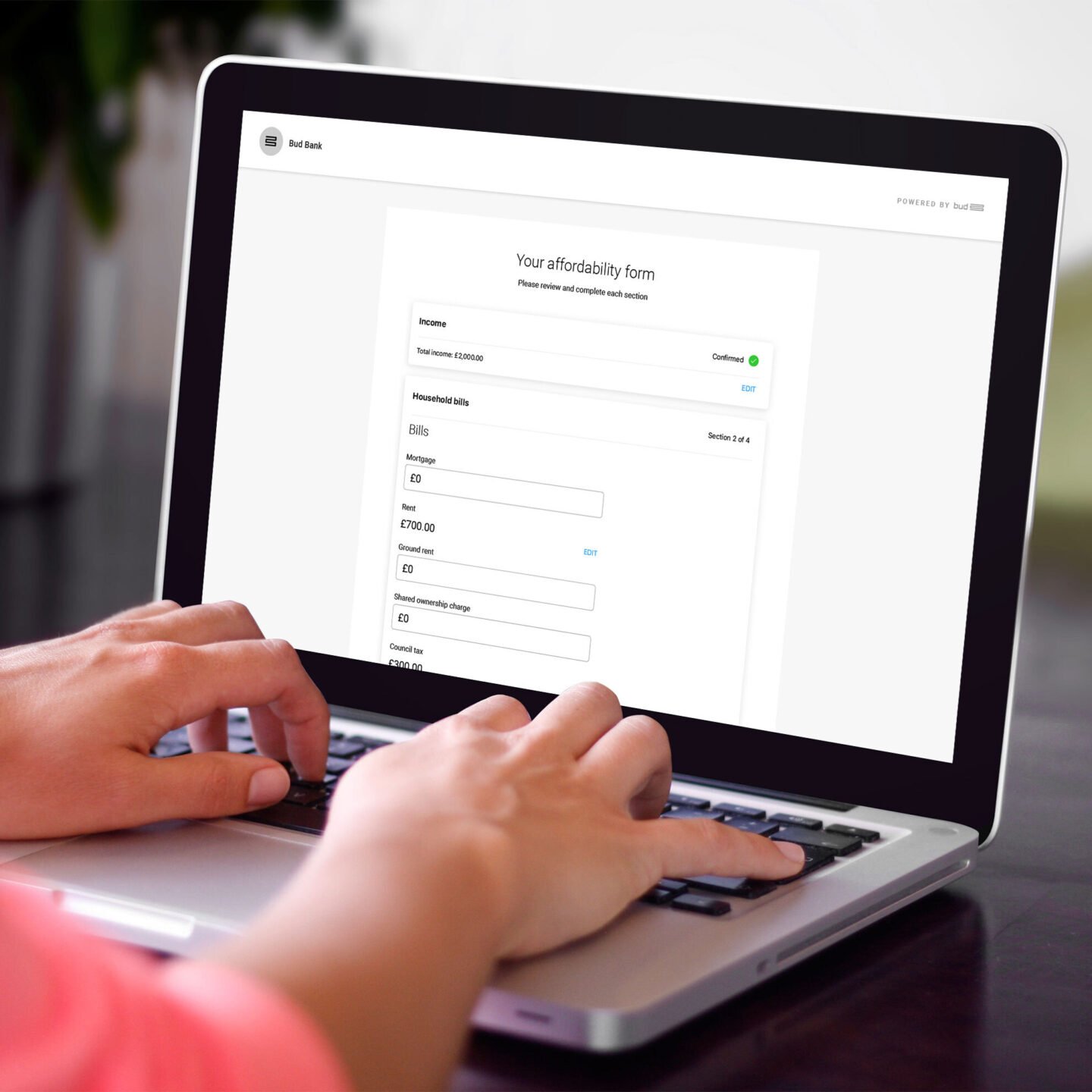

Pre-fill forms to make applications quick, easy and accurate.

Display income and committed spending such as bills and living costs.

Use the data and insight to reduce risk with informed decisions tailored to each applicant.

In use

Understanding affordable repayments

A lender's collections team, concerned with customers falling behind on repayments, has built a flow using Aggregation and Intelligence. To mitigate the huge number of drop-offs during the onboarding process we were able to automatically populate 60 out of 65 fields using aggregated data – completing more than 90% of the otherwise manual and laborious process.

- DEVELOPERS

- Platform

- API docs and guides

- Market coverage

- RESOURCES

- Reports

- News from Bud

- REGION

- United Kingdom

- United States

Bud is the trading name of Bud Financial Limited, a company registered in England and Wales (No. 9651629).

Bud Website – Privacy Policy | Website terms and conditions | Cookie Notice | Privacy Settings | For consumers: Your rights – Payments

Bud® is authorised and regulated by the Financial Conduct Authority under registration number 765768 + 793327.