Data-driven insights made easy

Drive allows you to instantly understand your portfolio and build high-impact segments

Empower your teams

to unlock the full potential of the rich transaction data you already hold and personalize your banking experience.

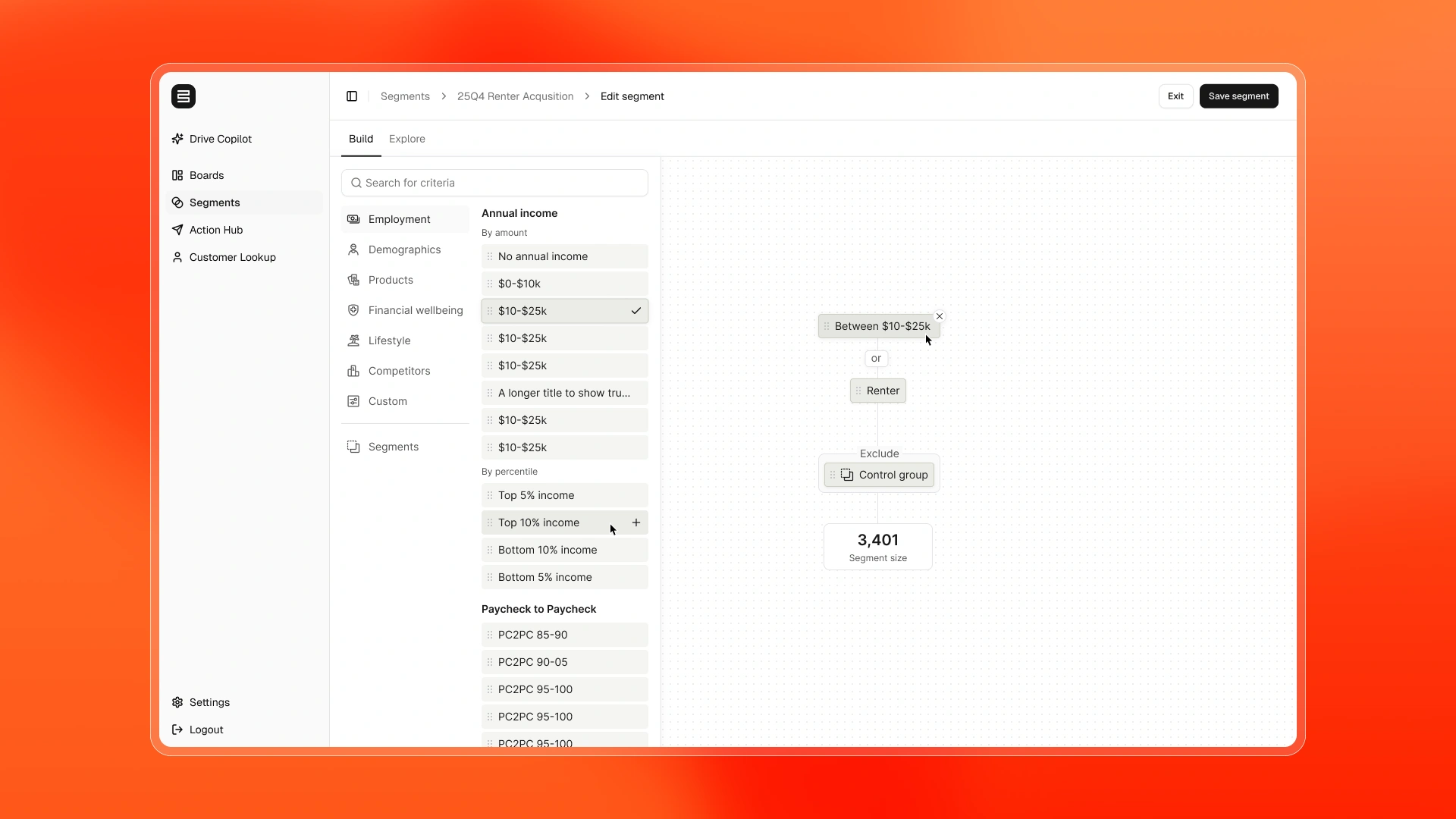

Analysing your portfolio has never been easier. From drag and drop segmentation to generative chat interfaces – we have made analytics easy so you can get to results in a matter of days, not weeks.

Drive allows you to instantly understand your portfolio and build high-impact segments

Use Drive’s Action Hub market directly to your segments and see results in real time.

Less waiting, more answers. Copilot helps supercharge your productivity. Ask anything and get answers in seconds, not weeks.

Cut through the complexity with easy-to-digest AI-generated highlights and summaries of your data.

Drive’s banker view ensures front-line bank employees get an instant understanding of their customer finances – beyond simple balances and generic insights.

Access categorised transactions and insights on affordability, income, cashflow, financial distress, and more, on one easy-to-use interface.

Use the AI-powered chat to summarize your customer’s finances and get answers on both general and detailed questions.

Unlock real-time insights across your customer base with simplified and accessible data analytics so your team can focus on more important, value-generating tasks.

Track and improve marketing campaign performance using data-driven insights surfaced by our AI-powered customer intelligence.

Understand and track real-time risk indicators and to inform business strategy and customer intervention.

Discover who your top competitors are, understand where customers are spending money and identify how your share of wallet compares to the competition.