Credit assessments

The fastest and most accurate way to evaluate creditworthiness - our industry-leading transactional data analysis means you can drive operational savings and grow your customer base.

Trusted by leading companies

Maximize lending revenue and mitigate risk

Deepen customer understanding with data-driven insights

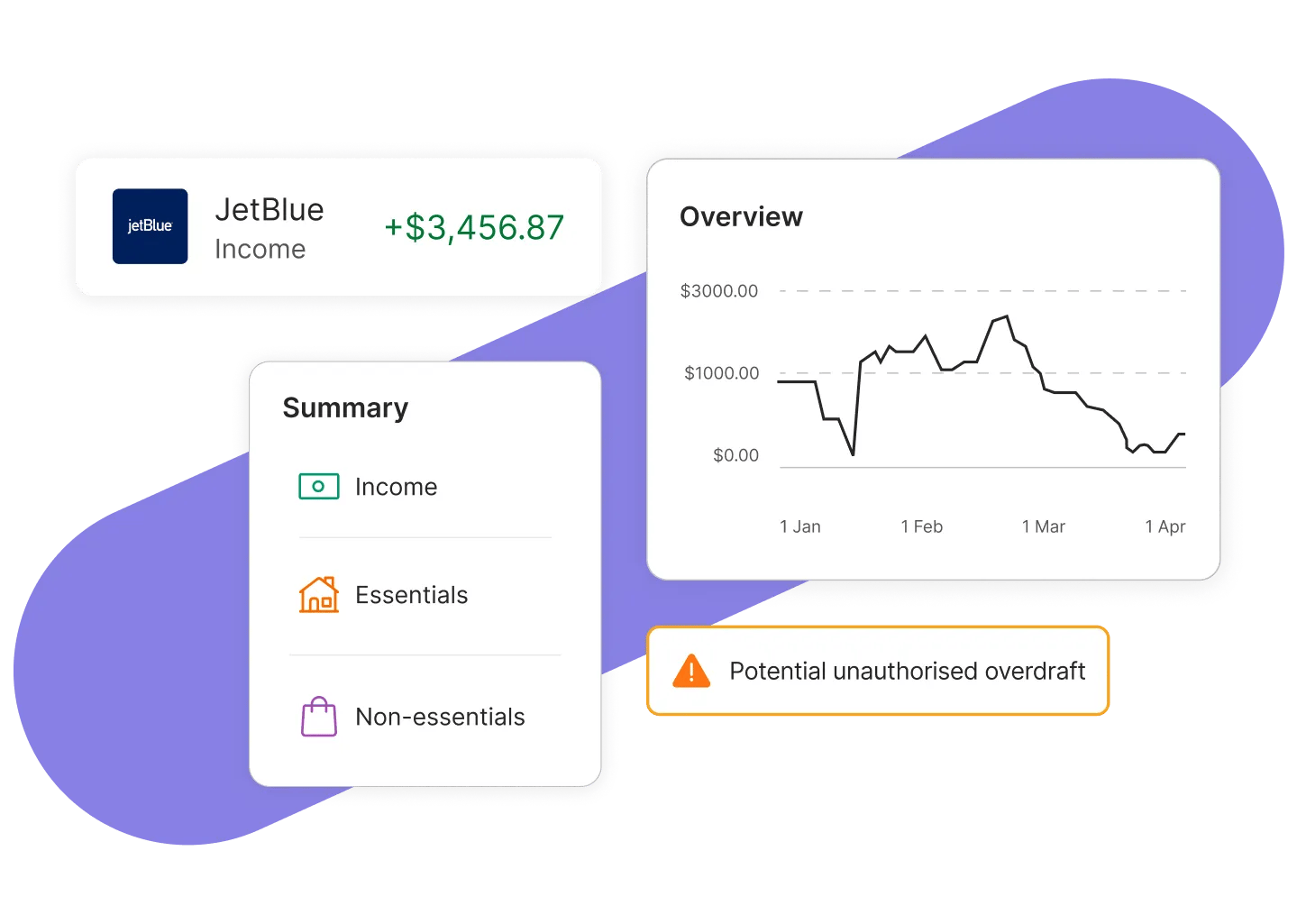

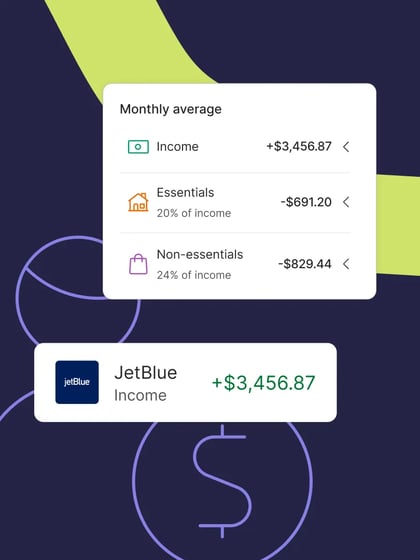

Using transactional data, we can easily understand the financial situation of your customers, from essential and non-essential spending to net disposable income and any financial products they use- including those of high relevance, like high cost short-term borrowing. This means you can ensure you’re offering the right product at the right time, every time.

Centralize decisioning for a complete overview of your customers

Our solution creates a holistic view of your customers’ financial profiles and situations. Because of our expertise in understanding and contextualizing transactions, we can combine high impact flags and overall creditworthiness with insights into relations with specific merchants. We then overlay it with income data (covering anything from stability to benefits) to provide a complete consumer overview for the most accurate credit decision.

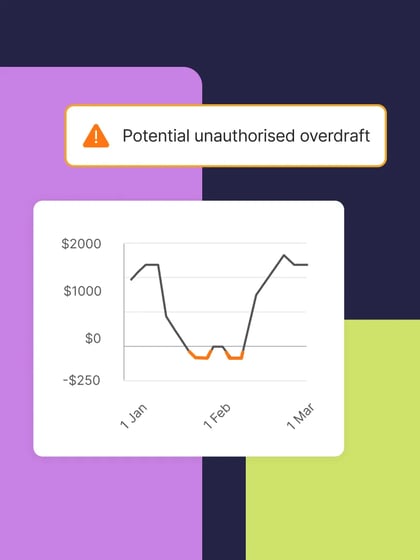

Identify and mitigate risk with smart flags

Financial transactions provide a vast source of insights into customer activities that might have a special meaning when assessing creditworthiness. We can easily flag anything from gambling spend and big cash withdrawals to failed direct debits, collections and unauthorized overdraft – meaning you can be sure no warning signs have been missed.

Benefits for you and your customers

At Bud, we provide industry-leading transactional data analysis so you can lend with confidence, knowing that you’ve taken a robust approach to the decision and avoid defaults.

-

Increase accuracy and approval ratesUse customer transaction data via open banking to provide a complete picture of your customers' financial profile.

-

Reduce operational cost

Streamline the underwriting process by automating data collection and analysis to reduce operational costs without compromising on quality.

-

Improve customer experience

Provide your customers with personalized advice that is both realistic and achievable because it’s based on accurate data.