Credit monitoring

Monitor your customers’ financial profiles in real-time to identify vulnerable customers before they default or to offer the right product as soon as they become eligible. Act on changing financial circumstances today.

Trusted by leading companies

Maximize lending revenue and mitigate risk

Nurture customer relationships and drive lifetime value

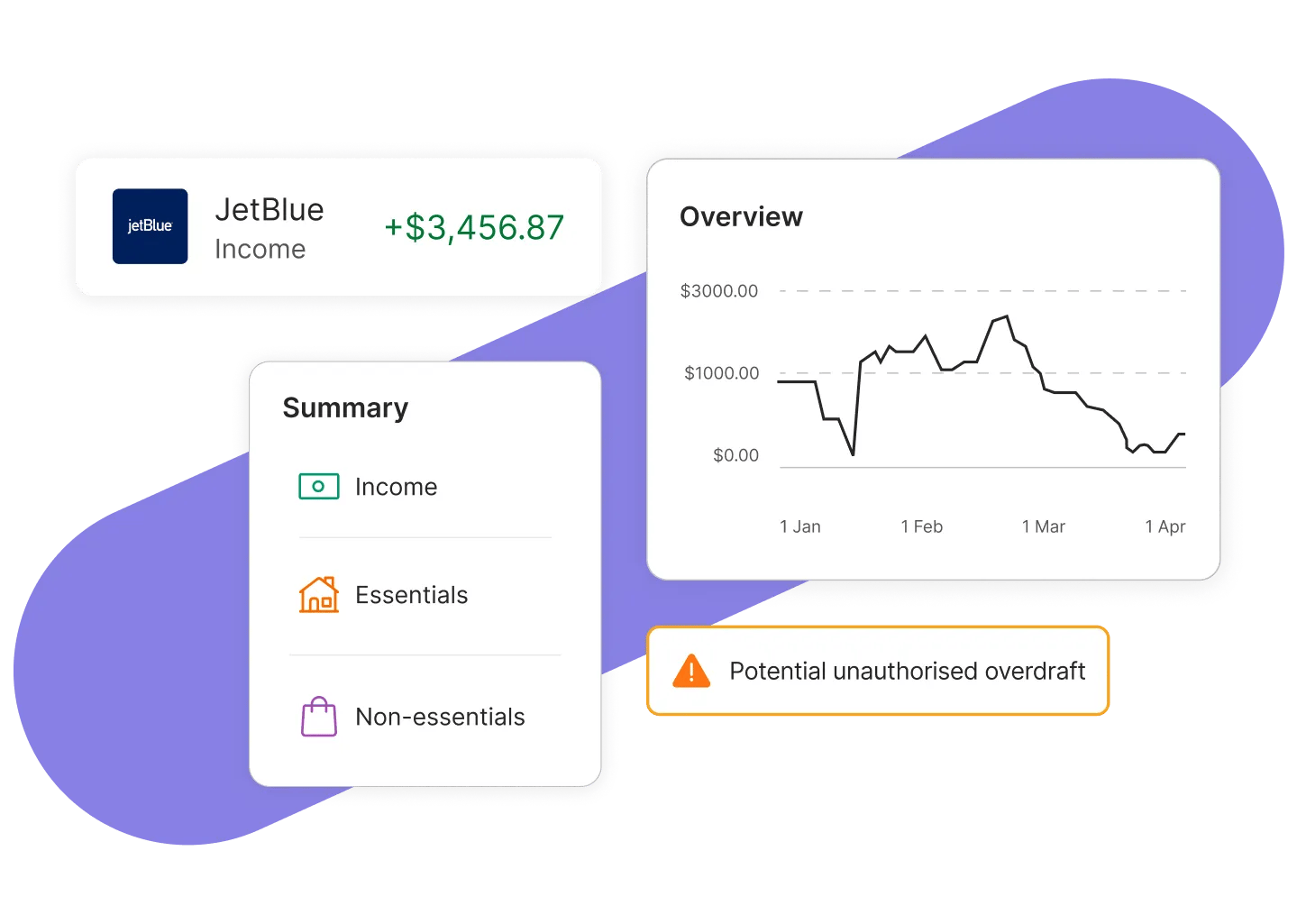

Credit monitoring takes our highly accurate understanding of a customer's financial situation and turns it into a continuous relationship. We can provide ongoing monitoring of customer’s transactions or perform scheduled or ad-hoc checks, instantly surfacing any meaningful changes.

Mitigate risk and avoid delinquencies

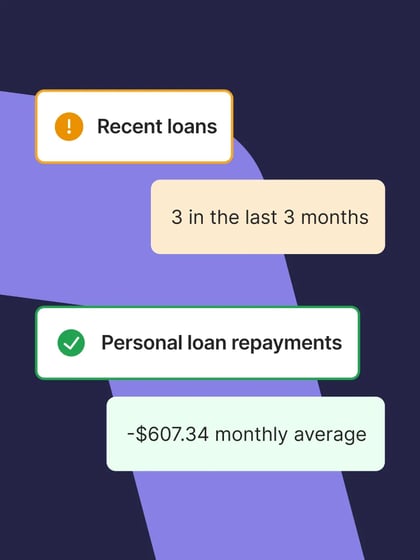

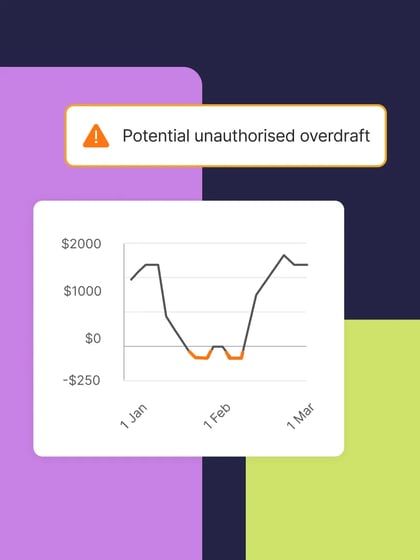

We can continuously apply creditworthiness insights so that at any point in time, our clients have full understanding of the risk status of their lending portfolios. We can spot worrying trends or red flags. This means we can let you know that a customer's financial situation is worsening, letting you act in time. In many cases, a small adjustment might make a difference between keeping up with the payments and opening up a collections case.

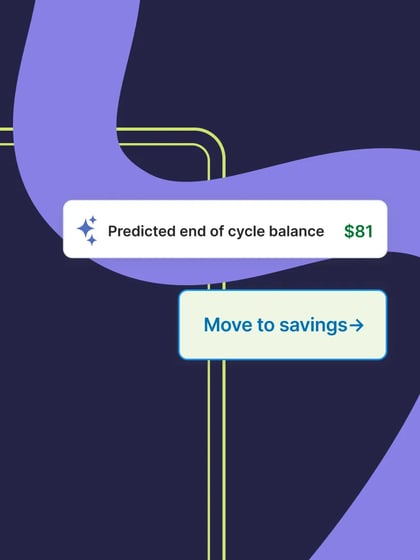

Offer customers the right products at the right time

Use your understanding of how customers are using their products to proactively intervene when they could be on a better suited product. Notice a customer has unused deposits? Prompt them to set money aside in a savings pot. Notice a customer isn’t using their Credit Card? Maybe a loan is a better way for them to pay off their debt.

Benefits for you and your customers

Identify and act on changes in your customers' financial position in real-time, speed up applications and monitor existing customers for improved risk management.

-

Drive revenueProvide the right product offer at the right time, or protect against delinquencies with timely intervention.

-

Support struggling customers

Meet regulatory obligations and brand commitments to provide the best possible outcomes for your customers.

-

Hyper-personalize user experiences

Deliver on your customers’ expectations of hyper-personalized experiences by providing proactive support and relevant offers.