Income verification

Understand income to reduce risk and drive growth with a holistic view of your customers’ financial profiles. See an individual’s historical, current and predicted income to accelerate processing time and serve those in atypical employment.

Trusted by leading companies

Maximize lending revenue and mitigate risk

Deliver fully automated income verification

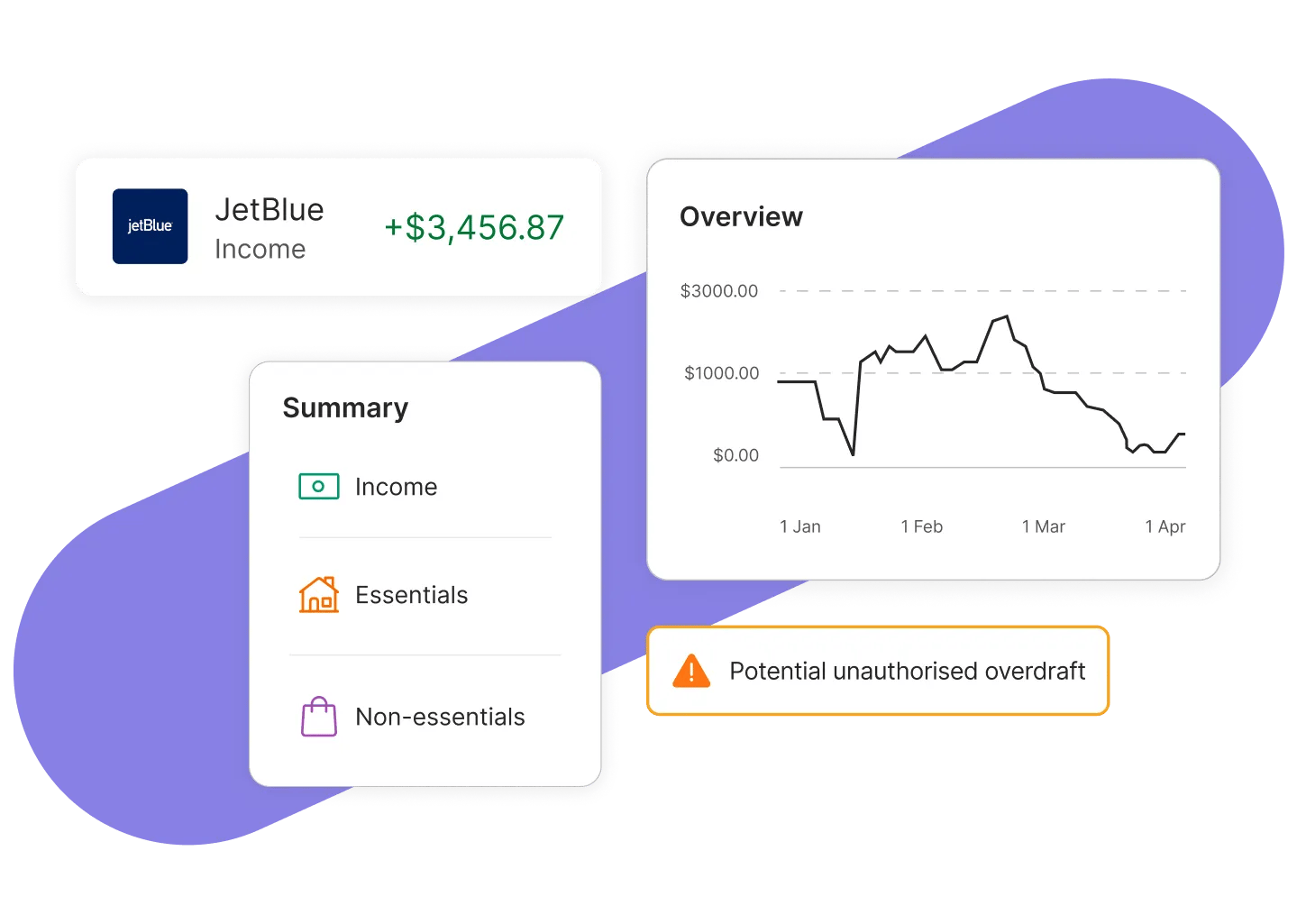

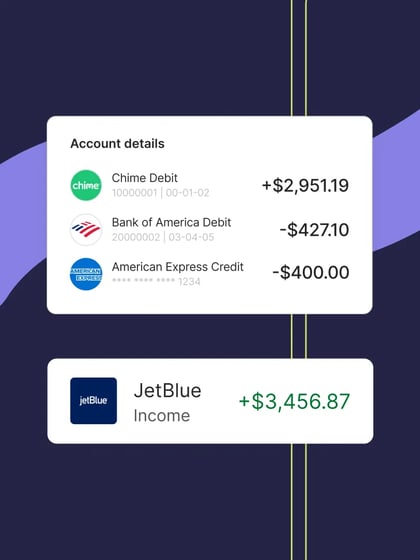

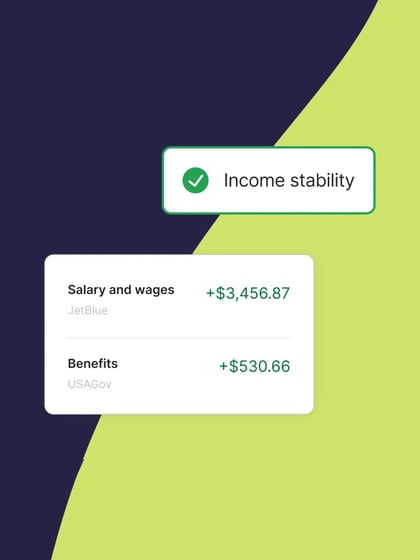

By taking into account all financial transactions, we can identify income transactions and patterns to provide a fully automated check on the main source of income but also flag any additional sources that may be of interest – e.g. benefits. We can also immediately evaluate income stability to safely supplement risk management and credit assessments.

Effectively handle complex situations with advanced analytics

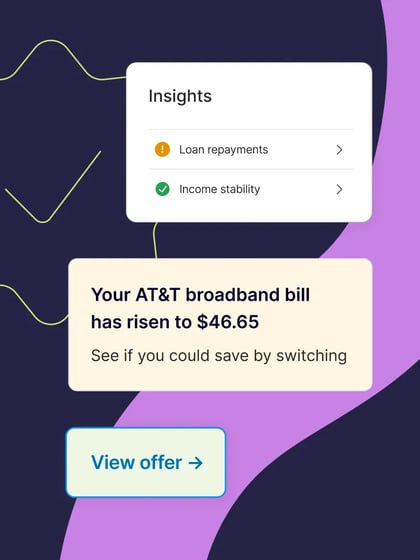

Our advanced income verification does not stop at basic payroll transaction search; in fact, we're able to identify variable sources of income, irregular employment, benefits and so much more. From multi-level categorization to merchant identification, our advanced AI-models simplify transactional data for a completely contextualized view of your customers’ financial profiles.

Accelerate data-driven decisioning with customer insights

Able to seamlessly integrate with your systems, all data processed by Bud can be shared across any of your other platforms. Our customer engagement features and data analytics platform can be easily fed into your CRM, data lakes or marketing engines to ensure every essential piece of information is both accurate and accessible.

Benefits for you and your customers

At Bud, we provide a reliable and straightforward means of seeing an individual’s complete monthly income, edge cases included. Track historical income, predict future income and review income stability or income shock indicators.

-

Accelerate decisioning

Reduce application processing costs by using Assess as an alternative to cumbersome review of paperwork and outdated or inaccurate credit reports.

-

Grow your loan portfolio

Responsibly lend to those with unusual income patterns who may find it challenging to access credit elsewhere.

-

Minimize risk

Offer appropriate products to applicants based on their true financial profile to limit delinquencies.