Deliver hyper-personalization and maximize customer engagement

Discover value in every customer transaction

Futureproof your solutions

With Bud, you can tap into a broad portfolio of AI-powered data enrichment, analysis and exploration features, capitalize on up-sell opportunities and maximize personalized engagement with transaction-based triggers that feed into your digital channels in real-time.

Drive value from every customer interaction and transform every touchpoint into a revenue-generating opportunity.

-

Tap into high-quality enriched data with multi-level categories, merchants and customer insights

-

Maximize product upsell rates through data-driven offerings and messaging tailored for consumers

-

Accelerate digital evolution and build on top of Bud’s expertly enriched data to deliver high-quality banking solutions

-

Capitalize on the troves of transactional data you already hold with democratized access to data exploration and analytics

Transform every touchpoint into a revenue-generating opportunity and unlock

Hyper-personalization at scale

/Engage%20.webp?width=855&name=Engage%20.webp)

Market-leading categorization

/Categorization.webp?width=855&name=Categorization.webp)

Democratized access to actionable insights

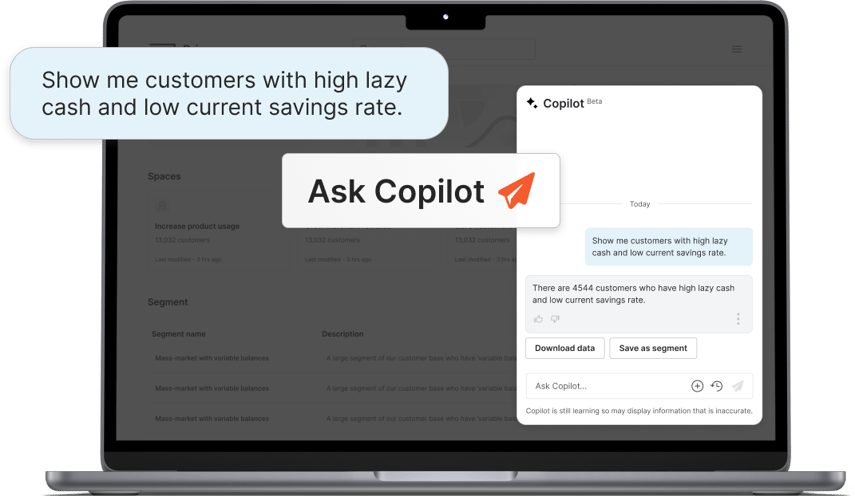

Empower your entire organization with democratized access to data exploration and analysis so any department can surface the actionable insights needed to succeed, with little to no technical expertise required

Complete customer segmentation

Maximized operational efficiency

Limitless engagement opportunities

Access to expertly enriched data

Deeper customer understanding

Underpinned by our powerful AI core

All of Bud’s solutions are supported and underpinned by our powerful AI core, which can seamlessly integrate with both first-party data ingestion and open banking sources and enabling fintechs to maximize their digital offerings using customer transaction data.

Beyond maximizing your banking operations and digital offerings, Bud’s platform can also support various business functions – from owners of digital channels to product strategy and risk management.

Interested in finding out how Bud can supercharge your fintech?

How to use GenAI to multiply customer insights from transaction data

An in-depth report by Bud and PA Consulting, with contributions from Google, DataStax and Zup Innovation.

Find out how and why to fortify GenAI banking with enriched transaction data, plus how to deliver business value at scale using GenAI.

From our blog

Podcast: Our CEO on 'Bud's amazing AI journey'