Leaders building with Bud

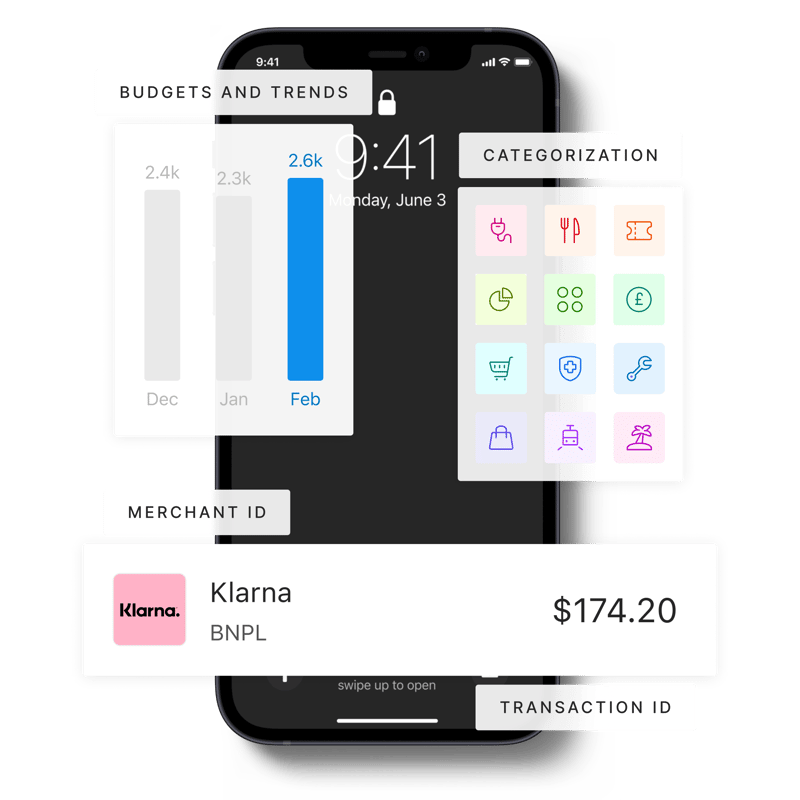

Next-level money management with Intelligently enriched data

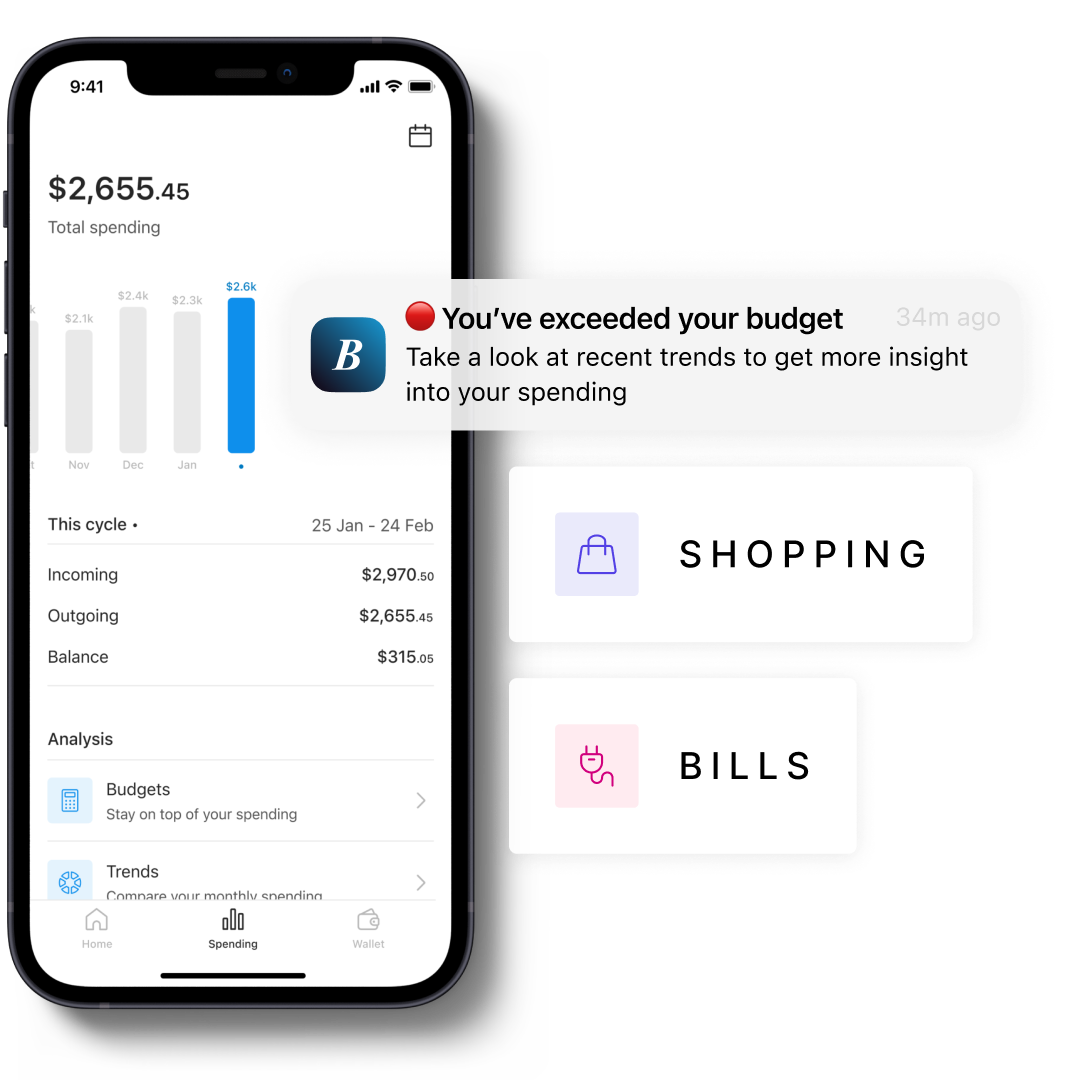

Drive customer engagement

90% of customers are willing to share data if doing so provides a simpler experience.

Improve financial wellbeing

69% of customers want tools to help them manage their finances better.

Build the ultimate personal finance management tool

Combine features like cash-flow forecasting and budgeting with smart, contextual notifications to improve engagement and retention.

Recognise rent payments

Our unique rent recognition solution serves as a credit-building tool that uses a customer's history of making rent payments to fill-out credit bureau records

Clients use rent recognition to acquire new customers, support those with poor credit histories, and boost loyalty. In the US, 26% of renters have expressed a willingness to switch banks or apps in order to have access to a credit improvement feature.

Carbon tracking

Bud's Carbon Tracking API gives clients the tools to help their customers understand the environmental impact of their lifestyle.

In-app engagement tools displaying carbon contribution alongside their spending have been proven to drive loyalty with 92% of people saying they will be more loyal to companies that support environmental issues.

What our customers are saying about Bud