Assess enables clients to produce an accurate assessment of a customer’s financial situation using open banking data. Simple to customize and fast to integrate, Assess provides the client with deep insight, and their customer with a friction-free experience.

Our advanced AI solutions deliver rich insights and accelerate data-driven creditworthiness decisions

Assess combines the most accurate enrichment capabilities with advanced data analytics features allowing financial institutions to leverage transactional data in lending and risk management.

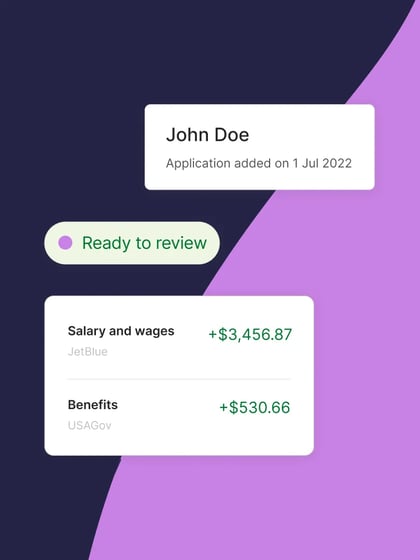

With Assess, every financial transaction can be turned into a source of meaningful insights. We use this information to power our client’s lending and risk decisions with Income Verification, help with accurate understanding of personal financial situations with Credit Assessment, and enable ongoing relation and advisory with Credit Monitoring.

Case studies

Empowering TotallyMoney

Our Engage product powers TotallyMoney’s ‘Monitor’ feature, which helps customers to understand their disposable income, as well as any forthcoming payments each month.

Accelerating applications

With Bud's Assess solution, Moneyboat are empowered with an accurate, data-driven view into their customer's financial situation.

Subscription management

Bud's AI-powered data intelligence platform identifies and categorises recurring payments so that consumers can cancel or switch to a better deal.

Frictionless lending with Bud

Seamless integration

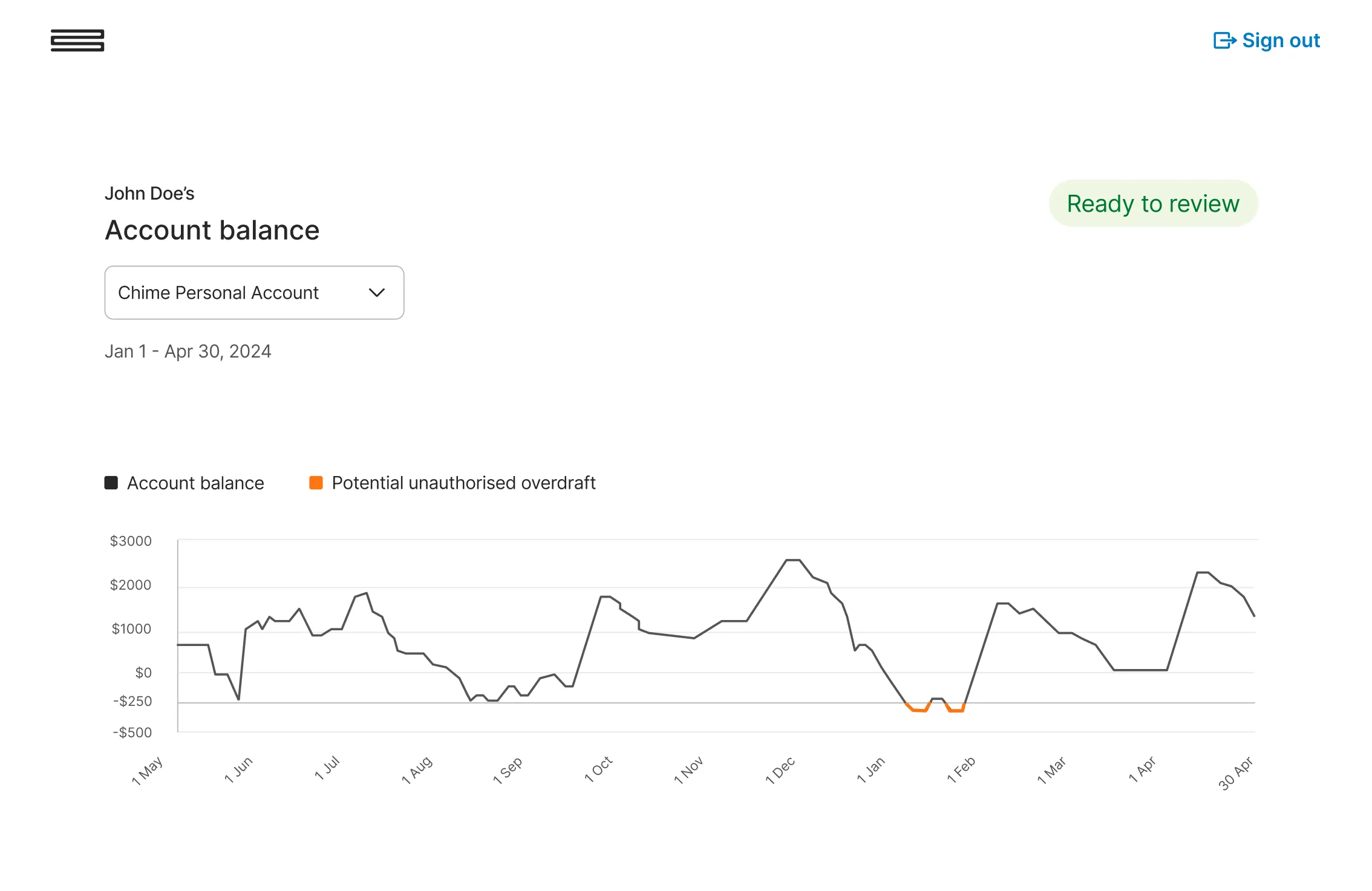

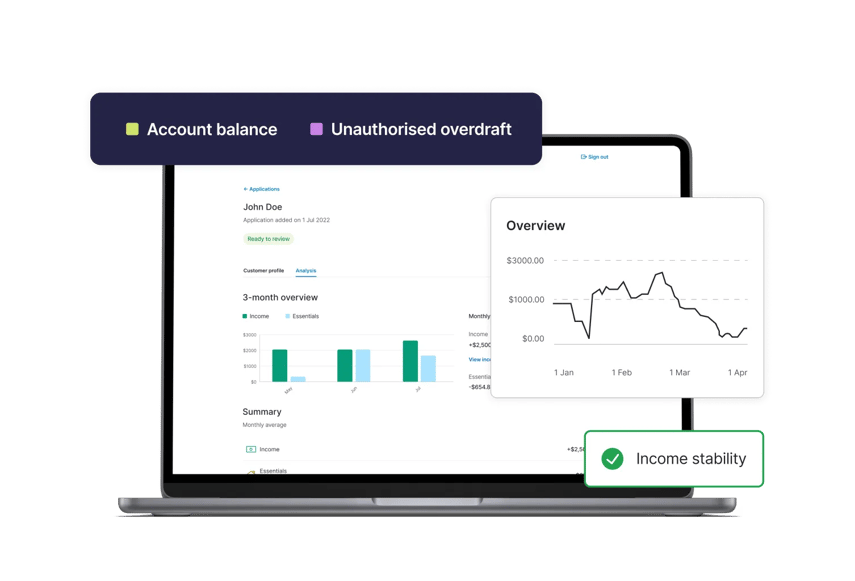

Assess builds on the data services offered by Bud’s core Intelligence platform, providing access to a customizable dashboard and a set of APIs that works on a per customer basis.

Whether clients need a customizable dashboard interface, simple pdf reports or a full API integration, Assess works however you do to get you up and running fast.

Drive lending revenue with Bud

Rely on data-driven accuracy

Use customer transaction data via open banking for a complete picture of your customers' financial profile.

Minimize and mitigate risk

Reduce risk by identifying problems or opportunities to intervene at every stage, from application to collections.

Maximize customer experiences

Meet customers' expectations with a streamlined credit journey and deliver the best possible financial outcomes.