How Bud’s ultra-precise transaction categorisation and merchant identification powers subscription management app Little Birdie

- Industries

- Personal financial management (PFM) fintech

- Goals

- Identify recurring payments to help consumers manage their subscriptions

- Type

- B2C

-

17,000 subscribersMore than half of the subscriber base are active users of this clever bill manager app.

-

4,500 open banking adoptersCustomers who connect at least one bank account or credit card to the service can see, understand and act on their subscription spending.

-

Identifying 10+ subscriptions per userLittle Birdie estimates that the average customer with a connected bank account could have at least 10 regular payments that could be optimised.

Martin Bould

Founder and CEO, LittleBirdie

Problem

Each year, £25 billion is wasted on unused subscriptions and ‘free trials’ which are often difficult to cancel. Research has shown that 1 in 4 people have signed up to a subscription by accident and 1 in 15 are in a subscription that they don’t use.

Little Birdie, a subscription and bill management app, is leading the charge to help customers identify, manage and cancel unused or unwanted subscriptions.

In order to scale quickly and effectively, Little Birdie needed a ready-to-go solution that could help them onboard customers and identify their recurring payments.

Solution

Little Birdie selected Bud's data intelligence platform to underpin and further enrich their subscription management application and IP. Using our Engage product, users can connect their accounts securely within the app.

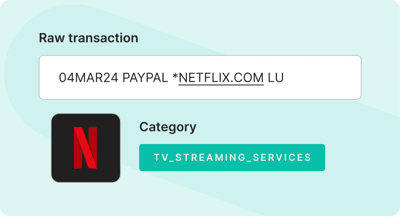

Our transactional enrichment model then identifies and accurately categorises subscriptions, helping customers to understand them and take action. With our >98% accurate categorisation, Little Birdie’s customers get precise insights into where their money is going so that they can take action.

Outcome

Having attracted some 17,000 app users since its launch in October 2022, the appeal of subscription management capabilities to consumers is clear.

More than half of the user base are active users of the app, and Little Birdie estimates that the average household is saving between £500 and £1,000.

4,500 people have connected at least one bank account or credit card to the service, and Little Birdie estimates these customers could have at least 10 regular payments that could be optimised.

From ‘set and forget’ subscription traps to underused gym memberships or expensive streaming services, customers of Little Birdie get visibility of all of their subscriptions and recurring payments, allowing them to identify opportunities to save and improve their financial position.

By giving consumers greater visibility of recurring transactions such as subscriptions and Direct Debits, apps such as Little Birdie can enable them to tackle ‘set and forget’ subscription traps, make valuable cost savings, and help to improve their longer-term financial resilience."

![]()

Thomas Purton

'Engage' Product Manager at Bud

Related case study

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.