Budgeting solutions

Better budgeting across your customer base means financial freedom for them and more cash in the bank for you, literally.

And the best way to achieve that? Partnering with Bud for financial innovation and growth.

Trusted by leading companies

Ways to help your customers

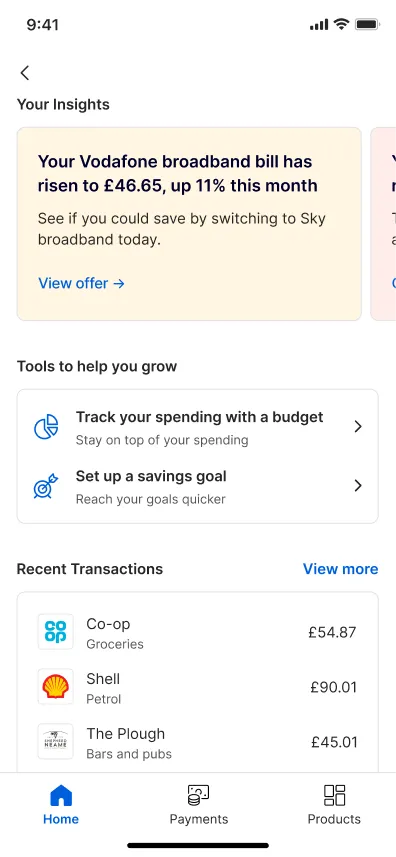

Track spending and set financial goals

Cultivate healthy financial habits, track spending and set achievable financial goals to ensure you can better serve consumers. Armed with the data-driven insights needed to facilitate better financial habits and financial well-being, each customer can deliver tangible lifetime value.

Frictionless budgeting experiences

Delight your customers with a seamless banking experience that empowers them to achieve their financial aspirations and directly improve not just the customer experience but also your NPS.

Happy customers translate to positive outcomes and positive reviews – all of which generate long-term financial return.

Grow deposits and improve wallet share

As long as your customers feel valued and supported with the right products, at the right time, there'll always be tangible benefits for everyone - from better money management solutions and personalised recommendations for them to increased wallet share and deposits for you.

Benefits for you and your customers

By leveraging Bud’s AI-powered data intelligence platforms to underpin your budgeting solutions, financial institutions like yours can maximise customer satisfaction, loyalty, engagement and ultimately, your Net Promoter Score (NPS).

-

Deliver hyper-personalisation at scaleCreate opportunities for meaningful hyper-personalised engagement at every financial touch-point

-

Drive customer retention and loyalty

Bud ensures you have the best intelligence needed to keep customers engaged, invested and supported in their financial journey.

-

Empower financial freedom and well-being

Deliver data-driven insights and recommendations tailored to your customer’s individual and unique financial aspirations

-

Generate long-term financial growthSeamless integration ensures you’re able to focus on what matters most – delivering innovative and accessible financial services