Autosaving

An innovative plug-and-play solution, Bud's Autosaving combines our customer-facing transactional intelligence API with seamless integration to effectively facilitate autosaving for your customers.

Trusted by leading companies

Ways to help your customers

Personalise savings and messaging

Leverage behavioural, spending and transactional insights to send personalised recommendations, reminders and nudges to encourage customers to better manage their money for more personalised, data-driven savings.

Provide seamless autosaving automations

By saving money dynamically throughout the month customers are more likely to increase their deposits and reduce splurging at the end of a given month. Bud’s autosaving capabilities define, at an individual and personal basis, how much money a customer should be moving into savings each week depending on their spending habits and financial goals.

Deliver savings experiences that delight

Cultivate savings experiences that not only resonate with and delight your customers but also empower them to achieve their financial goals with minimal impact on their everyday spending habits.

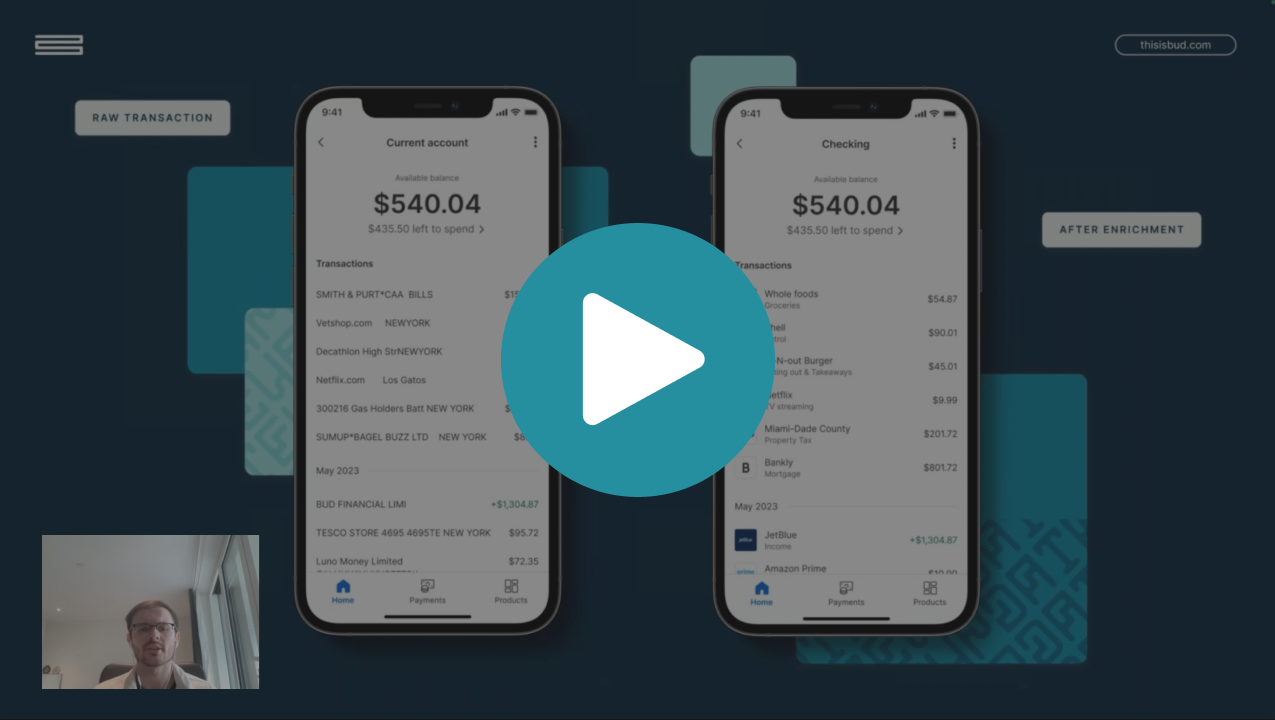

How to turn transactions into personalised insights

Available now

Tangible ROI and benefits

Effortlessly encourage customer savings without the need for constant manual intervention, promote financial well-being and automate the savings process so customers can steadily progress towards their financial goals with ease.

-

Increase customer savings

By automating the savings process, customers can steadily progress towards their financial goals and improve financial discipline with minimal manual intervention and friction.

-

Grow deposits and wallet share

When customers save more, it means more money in the bank for you too – literally. This means every time they save, your pool of resources grows and so does your share of wallet

-

Maximise ROI and revenue

Autosaving drives increased customer engagement, loyalty and retention which not only improves customer lifetime value but also revenue, profitability and ROI.