Manage everyday spending

Help your customers say goodbye to spreadsheets and better manage their everyday spending with easy, intuitive features designed to build financial awareness and resilience.

Trusted by leading companies

Ways to help your business

Category and Merchant totals

With customers prioritising convenience, Bud allows you to empower your customers with a quick, holistic overview of their spending breakdown by showing key categories or merchants they're spending the most on.

Proactive notifications

With rich insights surfaced directly from your customer bases' spending patterns, you're well equipped to predict and forecast situations before they happen. This foresight empowers you with the ability to notify customers of upcoming payments, if they're about to reach their credit limit or if they're unable to cover their bills this month.

Intro

Recommending budgets

Bud’s deep understanding of your customer's transactions allows you to identify the categories where the majority of a customer's discretionary spending is happening. This enables you to seamlessly recommend appropriate budgets on an individual basis, taking the labour off your customers and empowering them to better manage their finances.

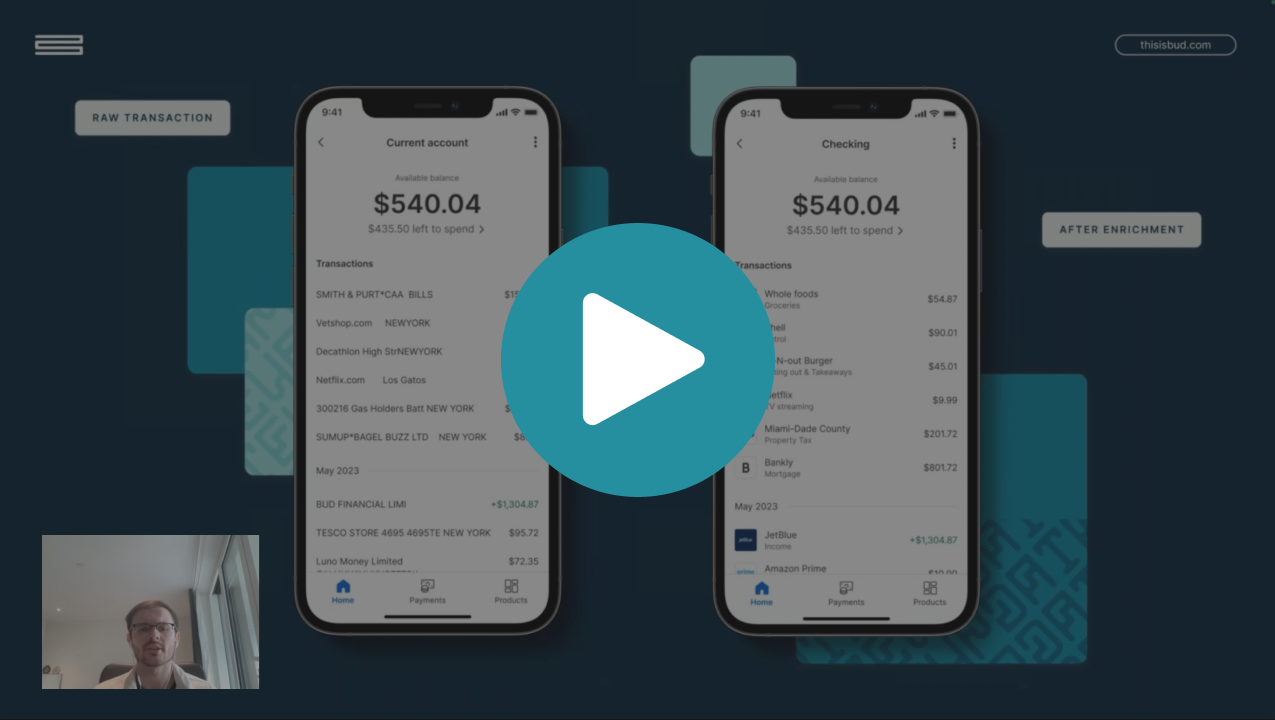

How to turn transactions into personalised insights

Available now

Benefits to you and your customers

Financial resilience starts with education, meaning customers who understand their everyday spending are more likely to make better, well-informed decisions and improve their lifetime value to you as a customer. With Bud, you can:

-

Remove friction for customers

Simplify how your customers engage with their money through market-leading categorisation and money management tools designed for financial clarity and improvement.

-

Improve customer experience

Support your customers with hyper-personalised experiences that align with their financial goals and expectations with solutions tailored to their unique situations.

-

Increase financial awareness

Equip your customers with the data-driven insights needed to improve financial clarity, understanding and resilience with personalised recommendations, suggestions and product offerings for improved NPS and loyalty.