Pay is Bud's open banking payments solution service. It offers a fast, cost-effective payments solution via open banking that reduces both fraud and friction for end-users.

Why Pay?

Pay enables clients to initiate account-to-account payments on behalf of their users. It's fast, safe, and extremely cost-effective vs alternatives like the card rails.

Customers want ease of use

59% of users would prefer to pay account to account

The best open banking coverage

We cover the vast majority of all current accounts in the UK.

Everything you need to revolutionise your payments journey

Easy to integrate

Simple APIs ensure clients get product to market fast.

Flexible payments

Initiate single payments and create scheduled payments or standing orders.

Thorough auditing

Track payments through a merchant dashboard.

Licencing

Use your own PIS licence or become an agent of Bud.

How clients drive growth with open banking payments

Speed and efficiency

Receive money within minutes not days of the transaction being initiated.

Improved conversion rates

Allow customers to authenticate and pay in a few clicks without leaving your service, seamlessly integrated from onboarding to checkout.

Reduced fraud risks

Because customers approve payments within their bank apps, the details of their cards are never shared.

Customer retention

Our payments solution empowers clients to maintain the relationship with their customers and drive higher in-app engagement.

How it works

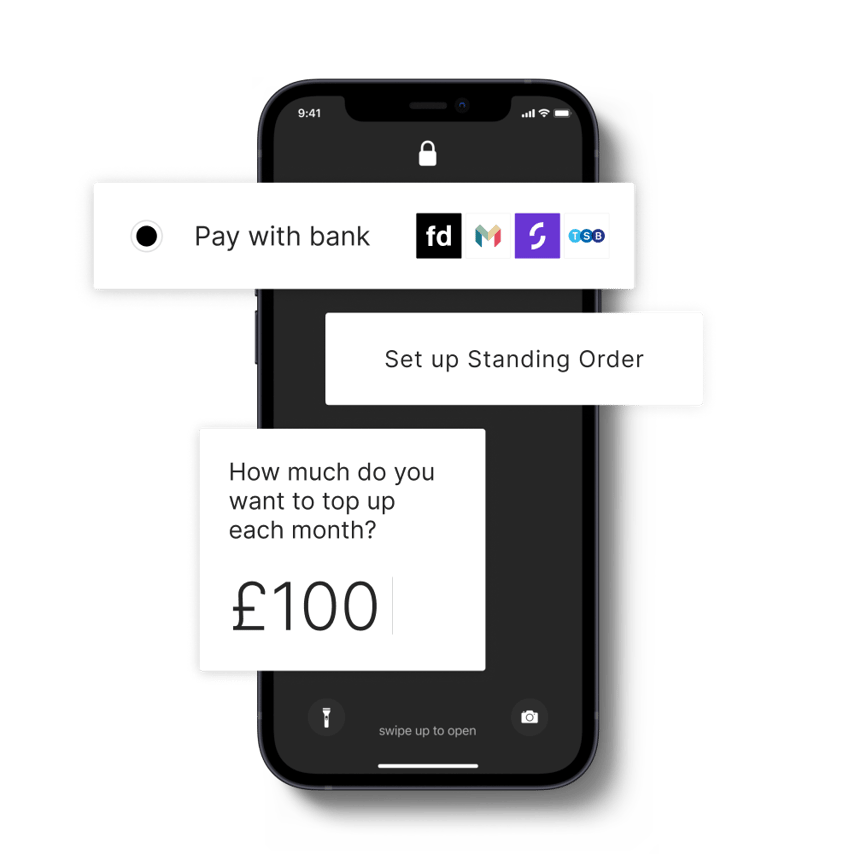

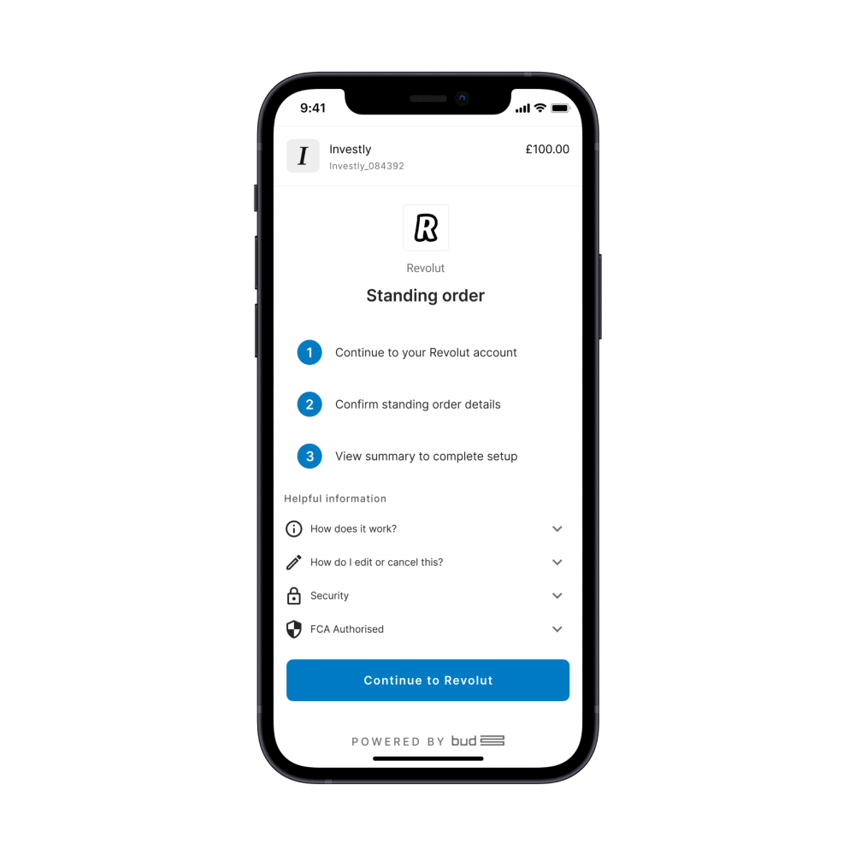

1. Create a payment or standing order

Post the payment details to the API and it will return an initiation link.

2. User authorises payment

The user clicks on the payment link, selects a bank and is redirected to their Bank app where they select a bank account, see the balance and authorise the payment.

3. User initiates the payment

The user is redirected back from the bank and the payment is initiated. Users will be prompted to approve any fees incurred before this happens.

4. Payment confirmation

The platform tracks the payment's progress and posts updates as it completes.

What our customers

saying about Bud

Ziad Al Baba

General manager UK and Canada, credit KarmaMike Bullard

Chief Information Officer, ANZ NZAlastair Douglas

CEO, TotallyMoneyDownload the Pay factsheet