It all starts with a transaction

Turn transactions into opportunities with Bud's AI-powered data platform

Build a complete picture of each customer

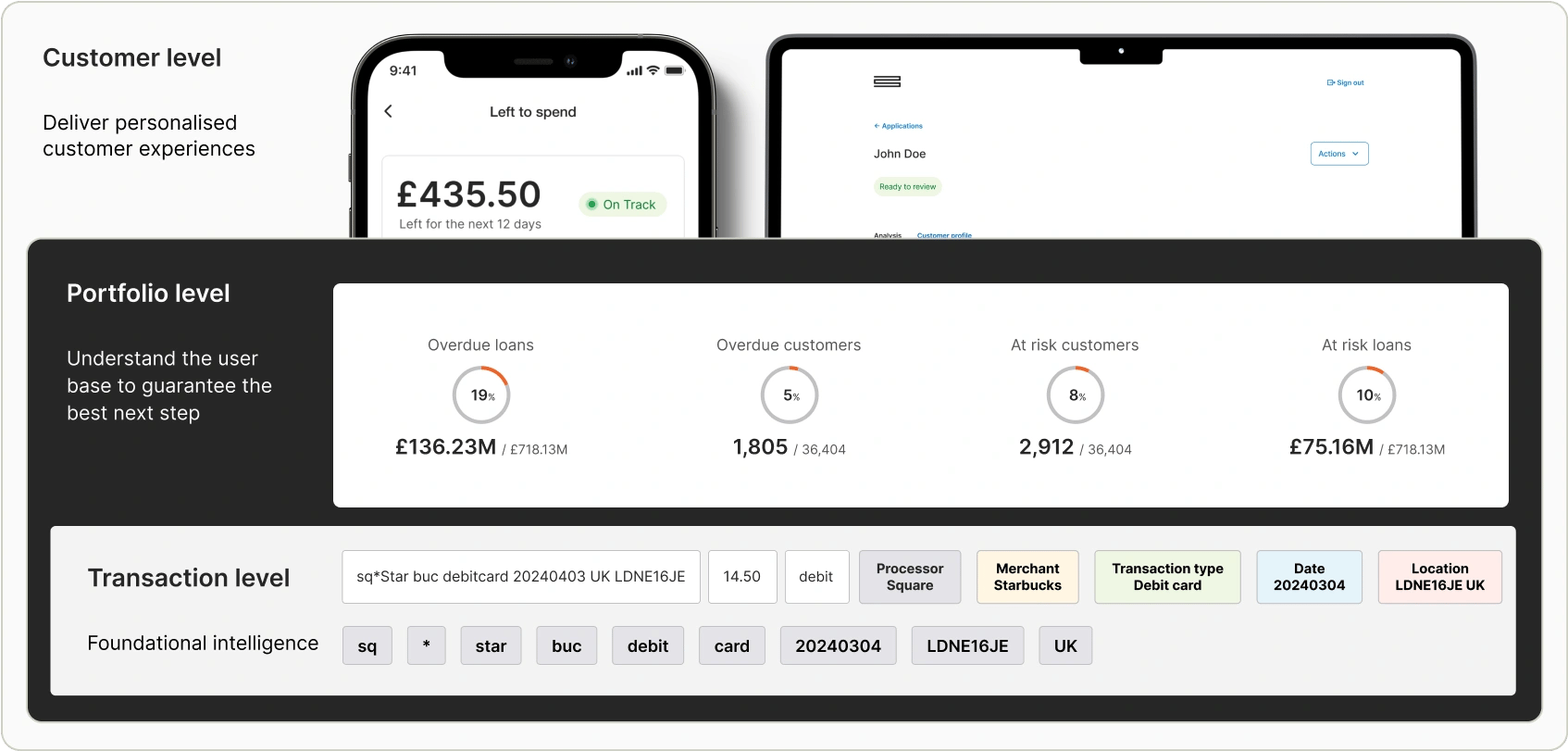

Transaction level

Portfolio level

Customer level

Leveraging trends, characteristics, habits and spending insights; we’re able to aggregate all transactional information to create a more in-depth understanding of your consumer base.

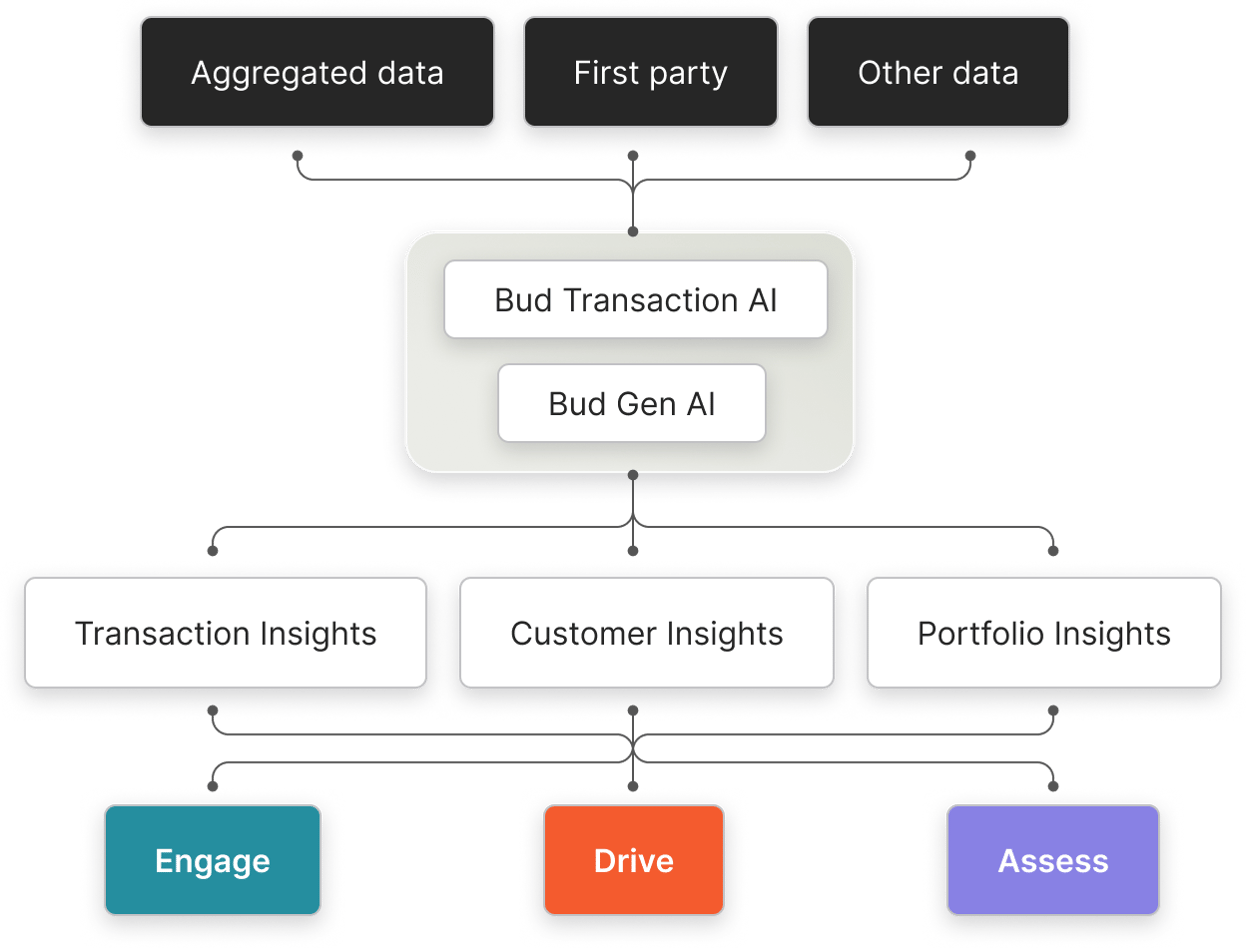

Through any data source

Meet our flagship products

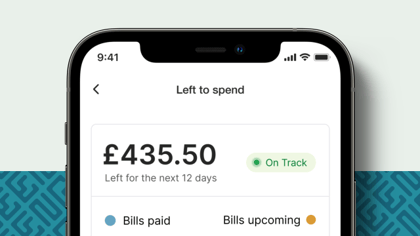

Engage

Personalisation and financial wellbeing

Personalised financial management for the closest relationship with your customers

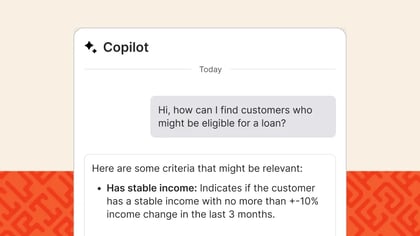

Drive

Insight exploration and marketing

Analytics and segmentation of your customer base to understand your customers and deliver personalised next best actions

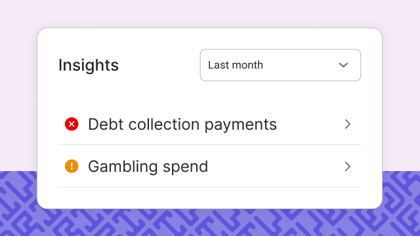

Assess

Lending and credit risk

Highly accurate lending suitability and lifecycle management solutions

Why work with us?

"Open banking is a huge opportunity, and our partnership brings this data into the lending ecosystem, enabling deeper insights for customers into their financial position and enabling better borrowing habits. This empowers our customers to step from ‘just about managing’ to moving their finances forward"

Alastair Douglas

CEO, TotallyMoney“Our partnership with Bud allows users to connect the Little Birdie app directly and securely to their bank accounts using open banking – seamlessly allowing us to identify all their regular payments – and manage their subscriptions in one place. We can then provide tailored insights to users helping them to save time and money”

Martin Bould

CEO, LittleBirdieMichael Hoare

CRO, FluroJulian Robson

Co-Founder, BeanstalkDaniela Padilla Vivero

Senior Product Manager, KrooMichael Bullock

Chief Information Officer, ANZ New ZealandKian Wanner

Director of Mobile Product, ZopaIncreased loan acceptance

Increase in app users

Increase in feature engagement in-app

Increase revenue by embracing personalisation at scale

Build with Bud

Unlock the ability to integrate Bud's data intelligence solutions with access to mock data, simulated account connection flows and open banking sandboxes - start building with transaction data today!