Customer loyalty and trust is paramount when it comes to delivering high-quality financial services experiences. After all, your Net Promoter Score (NPS) is a powerful metric not just for measuring a customer’s satisfaction, but also the overall financial experience you’re delivering.

For financial institutions, a high NPS is a competitive differentiator – it means your customers trust you. And trust unlocks a lot of tangible benefits, from improved customer retention and acquisition to boosted revenue and ROI.

But what is NPS?

What does Net Promoter Score (NPS) mean?

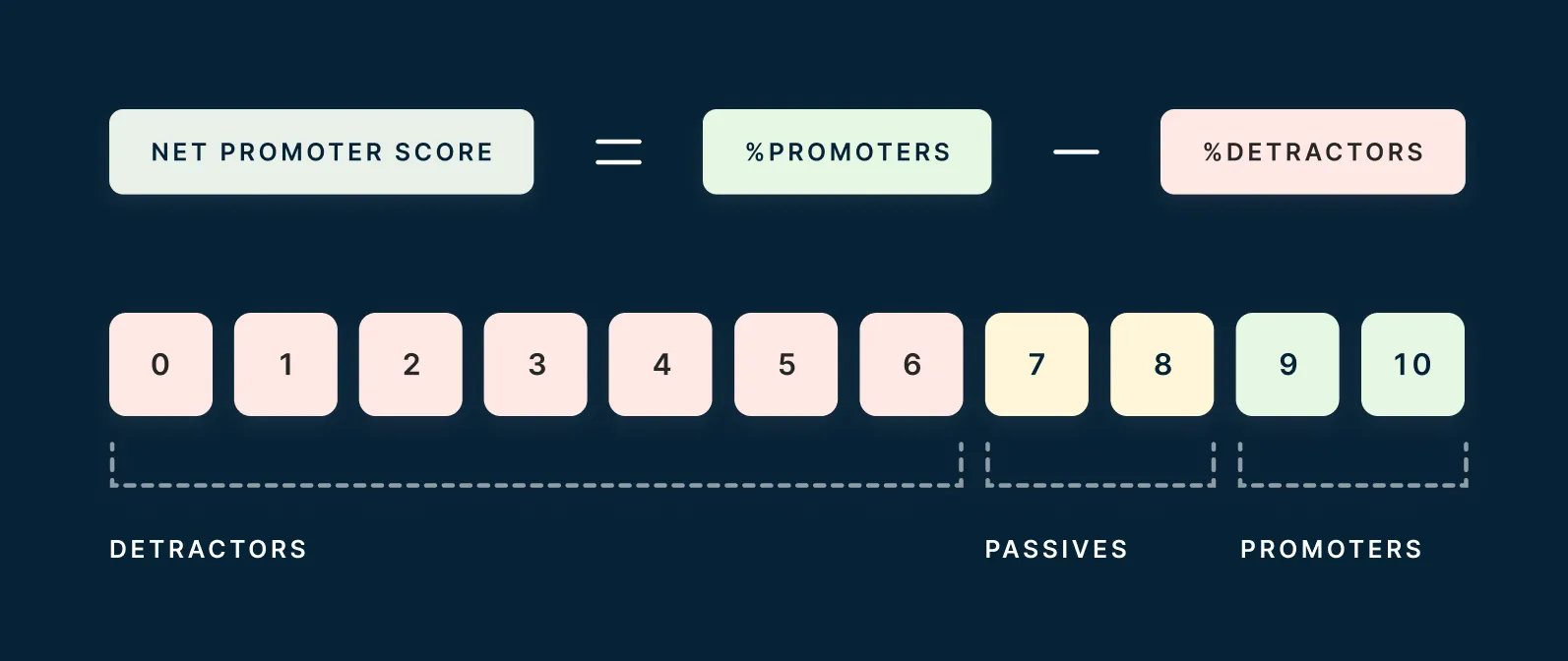

Your NPS is determined by how your customers answer: ‘On a scale of 0-10, how likely are you to recommend X?’.

NPS is then calculated by subtracting the percentage of detractors from the percentage of promoters.

What are promoters and detractors in NPS?

A customer’s satisfaction with the financial experience you’re delivering can be categorised into three groups:

- Detractors (0-6): Unhappy customers who are prone to churn and are potentially damaging to your company’s reputation.

- Passives (7-8): Neutral customers who are satisfied but not enthusiastic enough to promote your services.

- Promoters (9-10): Happy customers whose loyalty and trust in your institution means they’re likely to positively spread brand awareness through word-of-mouth.

This means the higher your NPS, the happier your customers are and the more likely they are to continue banking with — and buying from — you.

The importance of NPS for banks and fintechs

Attaining and maintaining competitive differentiation is difficult in today’s saturated market. Regulations are complex, customer expectations are continuously evolving and innovation is accelerating.

Fortunately, your NPS unlocks an actionable roadmap to navigate these complexities. With actionable insights into your financial institution’s strengths and weaknesses, you can better identify areas for improvement and in turn maximise customer acquisition, retention and advocacy.

Measuring and leveraging NPS as a financial institution

When it comes to measuring NPS, it’s crucial you get in the habit of collecting scores regularly. Whether it’s sending out a quarterly survey or asking for feedback across a variety of financial touchpoints, gathering real-time feedback is crucial to improving the quality of your services and keeping them in line with ever-growing customer demands.

But you can’t simply rely on the overall score, that’s just the first step. Instead, you have to dive into the data and analyse exactly why you’re getting the results you are. Segment your data by demographics, product usage and even channels to identify specific areas for improvement.

For example in 2023, Ipsos conducted a personal banking service quality survey in which they compared the quality of service from personal current account providers. The results clearly demonstrate that banks who invest in their digital experiences are more likely to have customers recommend them to friends and family.

Strategies for improving your NPS

Now that you’ve analysed the results of your NPS, it’s time to take action using the insights you’ve surfaced.

So, what are some strategies financial services providers can use to maximise NPS?

Cultivating customer-centric financial experiences

Making your customers feel valued is an important aspect of delivering high-quality financial experiences and this means ensuring a customer experience that delights.

By using AI-powered customer insights to anticipate their needs, you can construct seamless banking journeys that adapt and evolve as your customer’s financial goals do. This enables you to provide customer-centricity at scale.

Deliver seamless digital experiences

Delivering a seamless experience across all digital platforms, whether it’s through targeted messaging or personalised solutions, is vital to ensuring not only an experience that delights but one that warrants promotion.

By maximising the user experience, you can nurture customer relationships that evolve into advocacy, whereby their word-of-mouth advertisement generates a unique buzz unmatched by your marketing efforts.

Providing proactive solutions for financial freedom

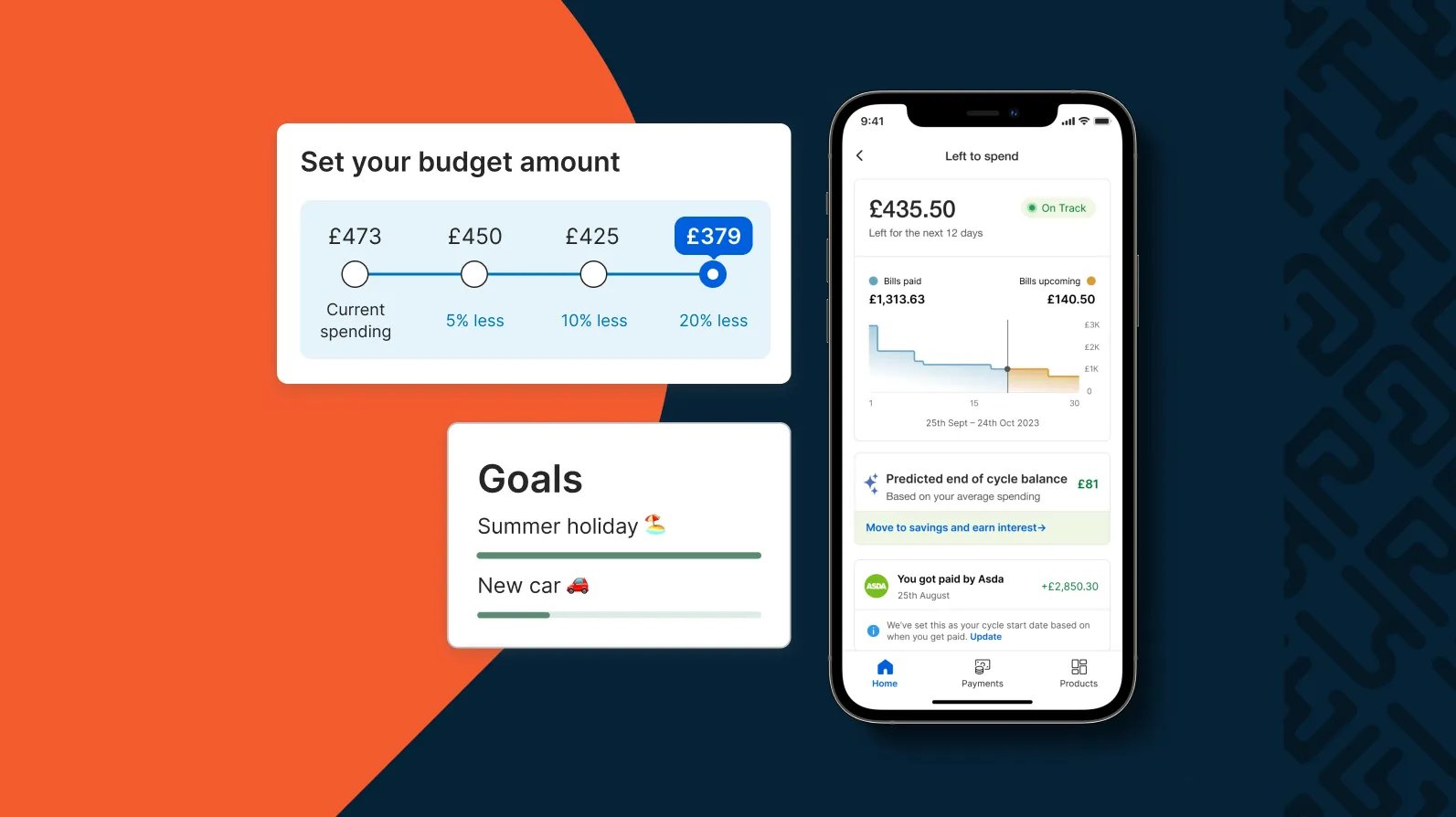

Empowering your customers with the tools they need to achieve their financial goals is a surefire way to cultivate trust, loyalty and, in turn, customer engagement.

Using your NPS results, banks and fintechs like yourself can proactively offer targeted financial solutions such as personalised savings goals, tailored product offerings and even budgeting assistance.

A customer-centric financial future inspired by NPS

Customer-centricity and the ability to adapt to a rapidly evolving financial services environment is crucial to the success of any financial services provider.

By using NPS as a strategic tool, financial institutions can unlock a future of sustainable growth and scalability, unparalleled competitive differentiation and long-lasting customer relationships that deliver revenue and growth.

Maximising ROI and Revenue with Bud

Want to get ahead of the competition and achieve true customer-centricity and hyper-personalisation?