Lending aggregators

Maximise loan conversions with market-leading aggregation and send pre-approvals in seconds using real-time affordability checks - improving conversion rates in the process by using aggregators and comparison sites.

Trusted by leading companies

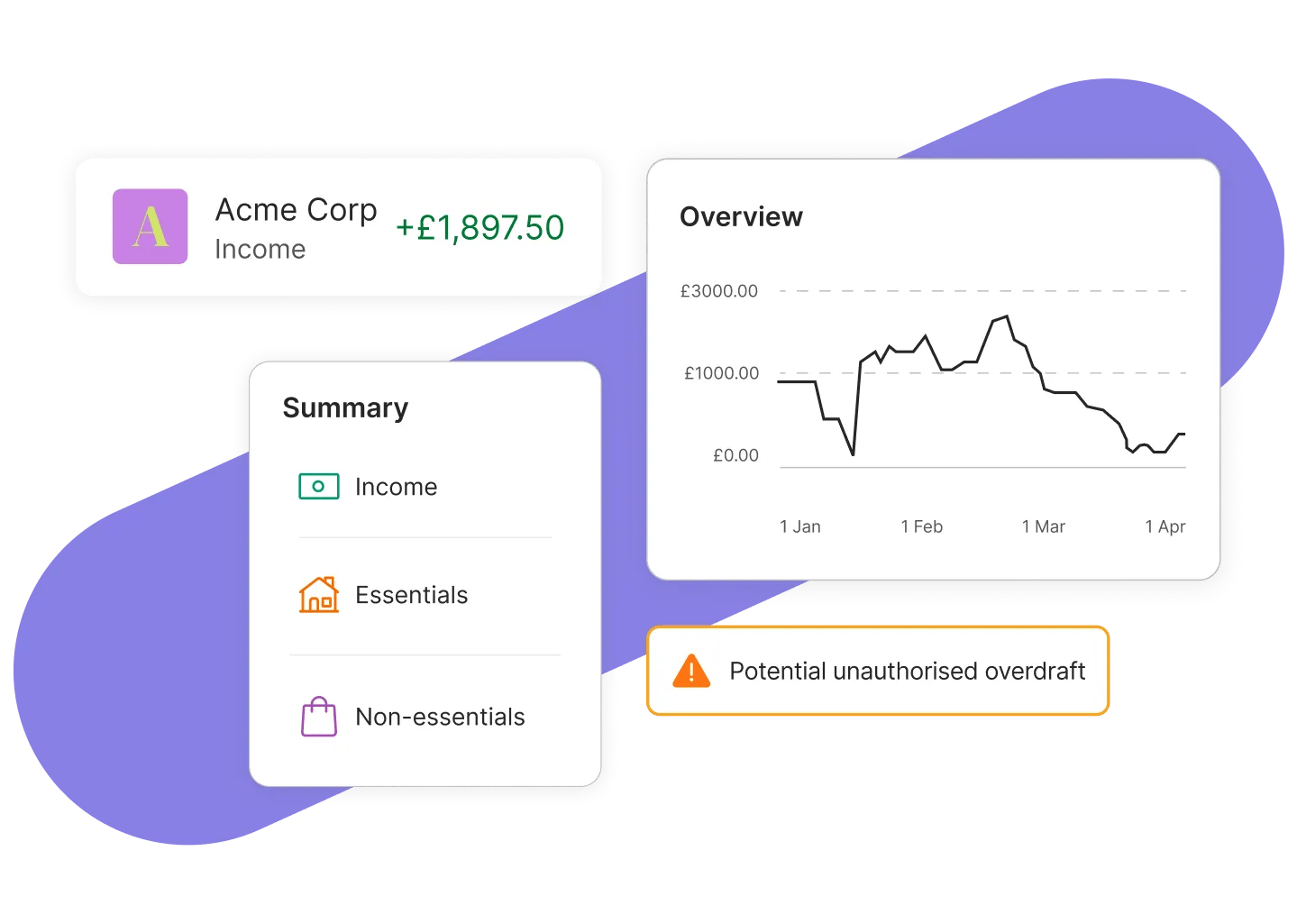

Maximise lending revenue and mitigate risk

Drive conversions and positive financial outcomes

With the wealth of data unlocked by open banking, financial institutions can now secure a more complete understanding of their customer's finances.

By leveraging and enriching spending and income data, you can ensure you're delivering truly personalised product recommendations at the right time, every time - improving financial outcomes for everyone involved.

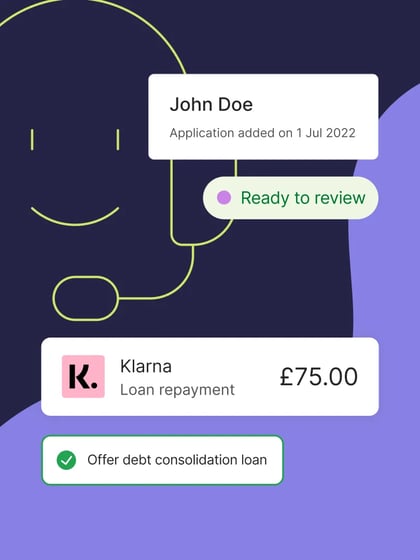

Reduce friction with seamless lending experiences

For smooth lending processes, data needs to be both accurate and up-to-date but customers rarely have that to hand – especially if it pertains to their financial habits… but providing consent for open banking is both faster and simpler than traditional forms.

With Bud, you can ensure all data is seamlessly integrated and accelerate the lending journey, making it considerably less stressful for all and leading to more informed conversations and better outcomes.

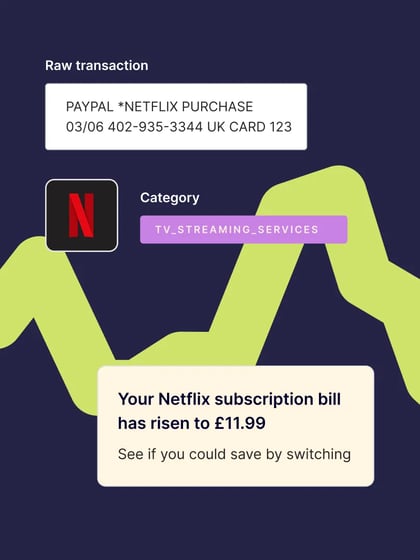

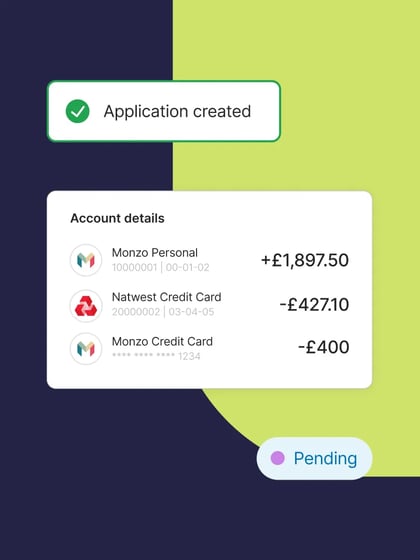

Accelerate data-driven decisioning with aggregation

Bypass tedious lending practices such as document gathering and accelerate data-driven decisioning with Bud’s lending aggregators.

This fast, simple open banking-based data aggregation enables quicker and more accurate decisioning and empowers financial institutions with rich customer insights and high impact recommendations.

Benefits for you and your customers

At Bud, we enrich and analyse transactional data collected by loan aggregators to provide automated, more informed eligibility assessments capable of empowering lenders to offer customers the best product and rate, improving uptake and approval odds.

-

Data-driven decisioningGet fast, accurate pre-approvals to meet tight aggregator response times and enrich applications instantly with transactional insights.

-

Increase profitability

Present ideal products upfront to convert quality applicants and boost successful applications.

-

Improve customer experience

Stand out with a streamlined lending experience where applicants benefit from swift, hyper-personalised lending experiences.