Collections

Get struggling or at-risk customers back on track with Bud’s AI-powered solutions. Use our best-in-class data intelligence to have informed discussions with customers and help them with a personalised repayment plan.

Trusted by leading companies

Maximise lending revenue and mitigate risk

Capitalise on efficient, cost-effective automation

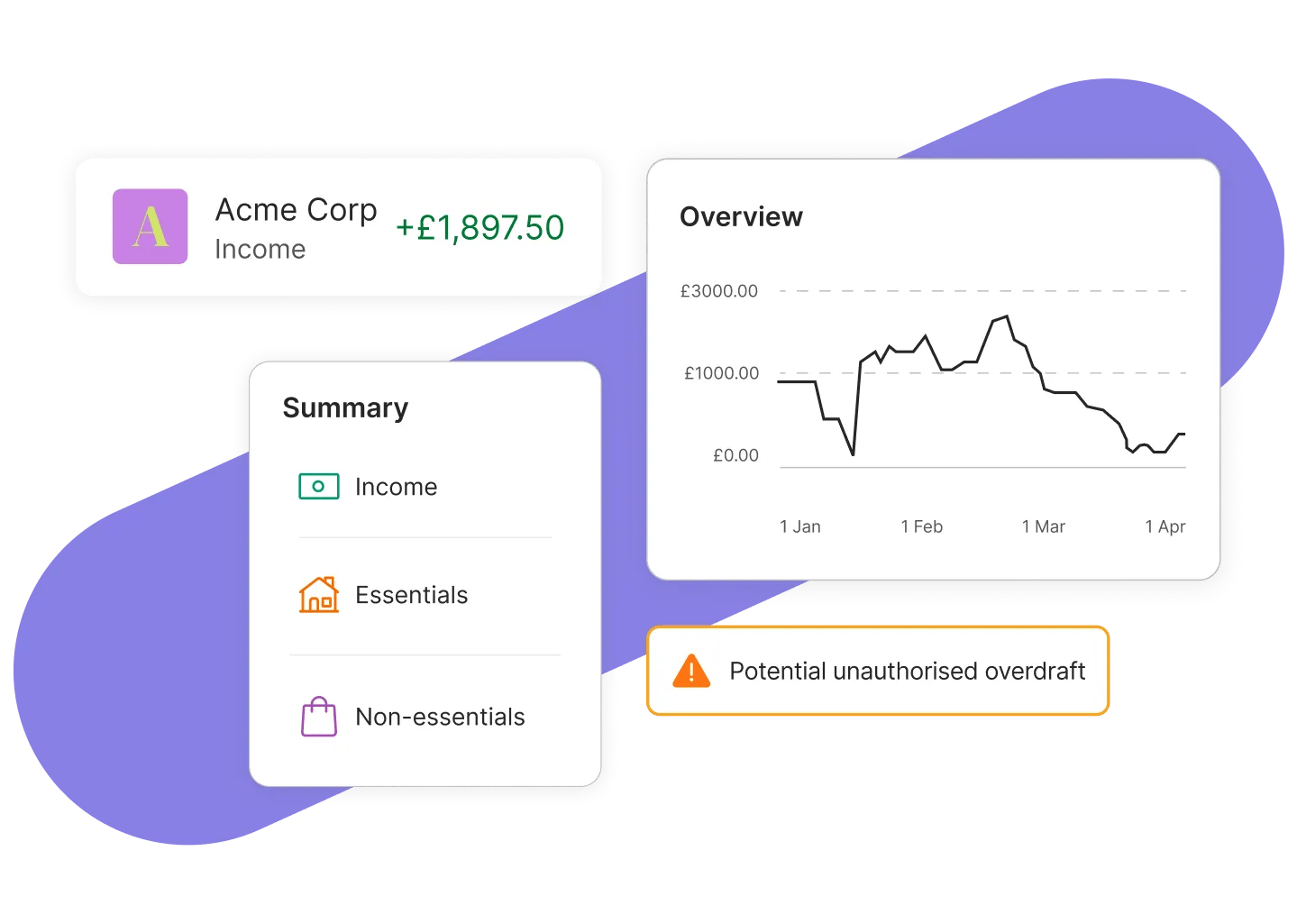

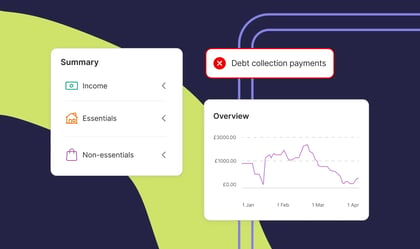

Collections journeys often require considerable effort from agents. Bud delivers unparalleled efficiency with automated data aggregation and enrichment, generating easy to understand summaries, flagging areas for improvement and risks and empowering agents to spend more time on the solution rather than raw data analysis.

Deliver accurate, data-driven advice for better outcomes

Providing tailored advice that’s relevant to each unique customer is difficult. Without major investment into resources and time, identifying meaningful areas for improvement isn’t always achievable. That’s why we provide personalised reports and insights tailored to each unique customer, increasing the likelihood of positive outcomes.

Benefits for you and your customers

Our best-in-class data intelligence means you get a true picture of an existing loan customer’s financial position.

With detailed information capable of truly personalising a collections journey, you can improve the chances of positive financial outcomes for both you and your customers.

-

Drive informed conversationsYour collections advisors can discuss options with customers, based on real-time information about their financial circumstances.

-

Support delinquent customers

Help customers who have defaulted to get back on track with personalised repayment plans based on transactional data insights.

-

Improve customer satisfaction

Provide your customers with personalised advice that is both realistic and achievable because it’s based on accurate data.