With the paradigm shift towards hyper-personalised financial experiences and digital journeys that delight, financial institutions are under pressure to create genuinely tailored experiences that resonate with their customer’s financial aspirations.

And the key to unlocking this customer-centric banking experience? High-quality data, market-leading categorisation and data enrichment capabilities that can underpin the most advanced personal finance and money management solutions.

Some institutions might view budgeting and financial health as ‘hygiene’ features. But, increasingly, consumer expectations on the accuracy and sophistication of these tools are heightened – not least because of continuing cost-of-living pressures.

Consumers today are less tolerant of ‘miscellaneous’ transactions or poorly targeted financial wellbeing messages. Accurate transactional data enrichment is the foundation for the more advanced personal financial management (PFM) experiences that drive real action and value in today’s hyper-personalised world.

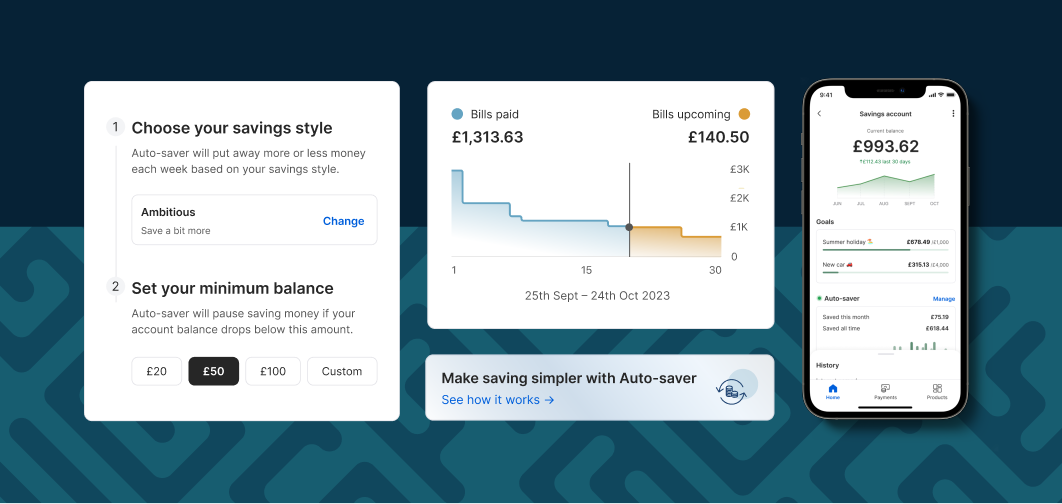

That’s where Engage comes in. With our AI-powered PFM solution, you can use our range of features including savings goals as a strategic way to drive engagement, loyalty and deposits for greater revenue.

Unlock savings success with Engage

More than just a PFM API, Engage gives financial institutions and banks a range of actionable customer insights that encourage engagement.

But how exactly does it do this?

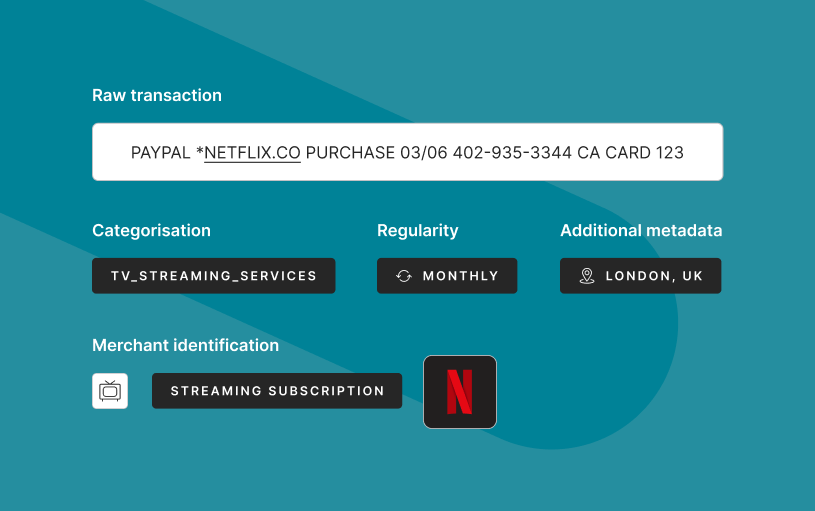

Engage: underpinned by market-leading categorisation and merchant identification

To best support your customers in meeting their savings goals, you need accurate data.

Engage is built on Bud’s market-leading transaction categorisation, boasting >98% accuracy, and:

- AI-powered categorisation: Accelerate data categorisation with real-time enrichment and granular accuracy.

- Regular payments tracker: Identify recurring transactions and their impact on budgets with pinpoint accuracy.

- Merchant identification: Best-in-class merchant identification, with a database containing tens of thousands of unique merchants spread across millions of locations.

By unveiling hidden spending patterns, Engage means your customers can set realistic and achievable savings goals, driving them towards financial success – and boosting your deposits in the process.

A holistic financial profile powered by core data enrichment

By delving beyond basic metrics, such as account balance, and enriching transactional data, Engage unlocks a complete portrait of your customer, with insights into:

- Financial health: from income and expenditure to debts, assets and savings; Bud ensures you have all the information needed to accelerate data-driven decisioning and personalisation.

- Spending habits: use Bud’s market-leading merchant ID and transaction categorisation services to better understand your customer’s spending and facilitate positive financial habits.

With this 360-degree view of your customers, you’ll be able to maximise personalisation at every touch point and recommend only the most relevant products or actions at the right time, every time.

Drive ROI through hyper-personalisation at scale

Imagine being able to tailor your product offerings and identify individual cross-sell and up-sell opportunities. You can make this a reality with Bud.

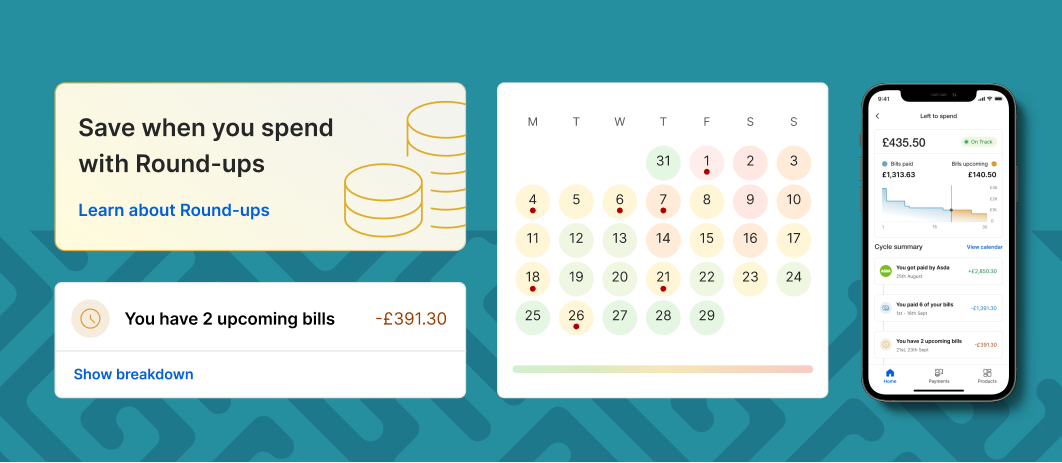

Engage takes customer-centricity to new heights, with hyper-personalised communication at scale. It allows you to:

- Deliver timely reminders, goal progress updates and personalised financial recommendations based on an individual’s complete financial situation.

- Recommend savings accounts and budgeting solutions that align with your customer’s personal and specific goals.

- Leverage gamification to incentivise positive financial behaviours and spending habits.

Deliver outstanding money management solutions

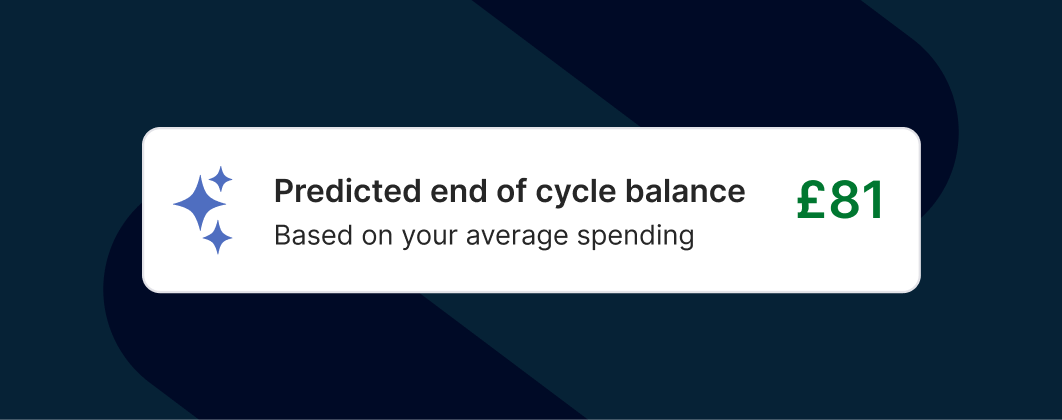

AI-powered data intelligence helps consumers to take control of their finances and achieve their savings goals with:

- Automated savings: Facilitate automatic transfers to savings accounts based on real time analysis of their spending and predictive cashflow modelling.

- Customisable budgeting tools: Help users to set budgets, track progress and receive alerts when overspending.

- Goal-based dashboards: Provide dedicated goal-based dashboards displaying progress towards specific savings goals.

These money management tools mean your customers can take tangible action towards their financial goals, fostering the trust and loyalty needed to succeed.

The outcome? Measurable ROI from increased profitability, improved customer lifetime value and a competitive differentiation in an already saturated market.

Maximise deposits with Engage

By integrating Engage into your stack, financial institutions like yours can benefit from:

- Improved deposits: Targeted savings goals encourage higher balances.

- Reduced churn: Personalised engagement strengthens relationships and discourages customers from switching.

- Cross-selling opportunities: Better recommend relevant products and services aligned with your customer’s individual needs.

- Enhanced brand reputation: A proactive and personalised approach fosters trust and positive brand perception.

Ready to learn more about Engage?